Automobile insurance coverage in toledo ohio – Automobile insurance coverage in Toledo, Ohio, is a an important facet of using within the area. This information supplies an summary of the native marketplace, exploring standard wishes, commonplace demanding situations, protection choices, and reasonable premiums in comparison to nationwide averages. It additionally delves into elements influencing prices, compares insurance coverage corporations, and provides pointers for locating reasonably priced protection. In any case, the information clarifies quite a lot of coverages and suggests native sources for additional data.

Navigating the complexities of auto insurance coverage may also be daunting, however this useful resource objectives to supply a transparent and concise figuring out of the Toledo marketplace. The comparability tables will let you assess other corporations’ choices and determine the most efficient have compatibility on your wishes.

Evaluation of Automobile Insurance coverage in Toledo, OH

Yo, long term Toledo drivers! Navigating the automobile insurance coverage scene generally is a general headache, particularly in a town like Toledo. However concern no longer, fam! This breakdown provides you with the lowdown on what you want to learn about insurance coverage within the space, so you’ll kick back and no longer rigidity.

Automobile Insurance coverage Marketplace in Toledo, OH

Toledo’s automotive insurance coverage marketplace, like many different puts, is a mixture of choices. It is a beautiful aggressive area, with a number of giant avid gamers and a couple of smaller ones, all vying for your online business. The marketplace is repeatedly evolving, adapting to adjustments in driving force demographics and using behavior. This implies premiums can vary in line with the precise cases.

Standard Automobile Insurance coverage Wishes of Drivers in Toledo, Automobile insurance coverage in toledo ohio

Toledo drivers, similar to everybody else, want complete protection that protects them from quite a lot of eventualities. This incessantly contains legal responsibility insurance coverage, which covers damages you reason to others, in addition to collision protection, protective your automobile from injuries. Scientific bills protection may be a key attention to hide scientific bills attributable to injuries. Figuring out those fundamental wishes is very important for making the proper alternatives.

Not unusual Demanding situations Confronted by means of Drivers in Toledo

Drivers in Toledo, like in all places else, incessantly face the problem of discovering reasonably priced insurance coverage that meets their wishes. Elements like the realm’s visitors patterns, twist of fate charges, or even the make and type of vehicles you power can affect the fee you pay. Any other problem is navigating the other protection choices and figuring out what is right for you. Additionally, staying up to date on adjustments to state regulations and insurance coverage laws is an important to steer clear of doable problems.

Kinds of Protection In most cases Presented in Toledo

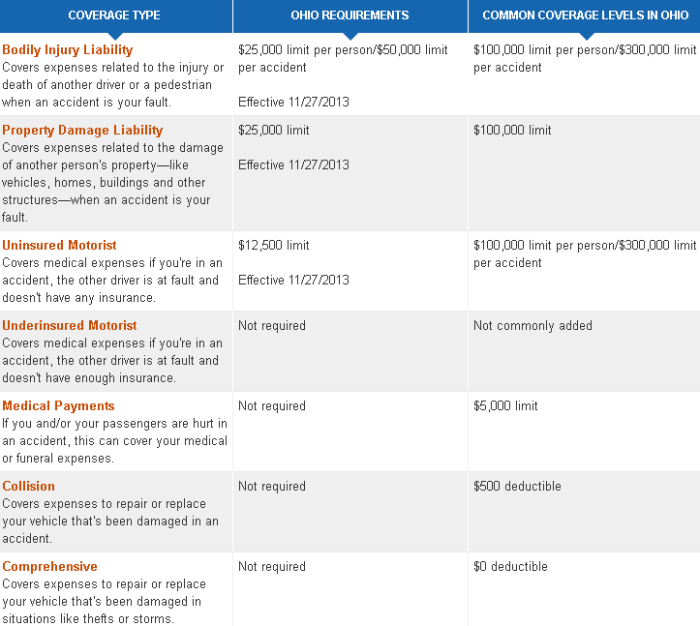

The everyday insurance coverage applications in Toledo be offering various coverages to satisfy other wishes. Those coverages come with legal responsibility insurance coverage (physically harm and assets injury), collision protection (injury on your automotive), complete protection (injury from issues as opposed to injuries, like climate), and uninsured/underinsured motorist protection (coverage if you are hit by means of anyone with inadequate insurance coverage). The particular choices might range between corporations.

Moderate Premiums in Toledo vs. Nationwide Averages

Insurance coverage premiums in Toledo typically fall someplace within the heart in comparison to the nationwide reasonable. Elements like the realm’s twist of fate charge and using behavior considerably affect the price. It isn’t all the time an easy comparability, regardless that, since other corporations can have other approaches to pricing. As an example, if an organization emphasizes security measures, it’s going to be offering extra reasonably priced charges.

Comparability of Insurance coverage Firms in Toledo

| Insurance coverage Corporate | Moderate Top rate (Annual) | Buyer Opinions | Protection Choices |

|---|---|---|---|

| Innovative | $1,800 | Combined evaluations, some cite ease of on-line get right of entry to, others point out inconsistent carrier. | Same old protection, reductions for excellent drivers. |

| State Farm | $2,000 | Normally sure, recognized for in depth community of brokers. | Complete protection choices, adapted help. |

| Geico | $1,600 | Most commonly sure, highlighted for his or her aggressive pricing and user-friendly web page. | Same old protection applications, quite a lot of reductions to be had. |

| Allstate | $1,950 | Combined evaluations, some reward their claims dealing with, others point out lengthy wait occasions. | Extensive protection variety, customized products and services. |

Observe: Those figures are estimates and might range in line with person cases.

Elements Influencing Automobile Insurance coverage Prices in Toledo

Yo, long term Toledo drivers! Working out your automotive insurance coverage prices generally is a general vibe killer. However figuring out the standards in the back of the ones premiums is essential to getting the most efficient deal. Let’s damage down what impacts your charges within the Magic Town.Realizing the fine details of your insurance coverage help you avoid wasting critical coin. Figuring out the standards that affect your premiums is an important to getting the most efficient conceivable deal.

Using Behavior in Toledo

Toledo using behavior play a big position on your insurance coverage charges. Competitive or dangerous using behaviors, like dashing, onerous braking, or common injuries, are large crimson flags for insurers. They build up your menace profile, at once impacting your premiums. This is the reason protected using practices are all the time a good move. Keeping off dangerous behaviors like tailgating or distracted using can considerably decrease your insurance coverage prices.

Automobile Sort and Fashion

The kind and type of your automotive also are regarded as when calculating your top class. Top-performance vehicles, for example, incessantly include upper insurance coverage prices because of the larger menace of wear or robbery. Insurers use elements like the automobile’s worth, its make, type, or even its age to decide your menace.

Using Historical past

Your using historical past is a big determinant of your automotive insurance coverage charges in Toledo. Injuries, visitors violations, or even claims all give a contribution on your general menace rating. A blank using report is your absolute best guess for decrease premiums, and keeping up a excellent using historical past is all the time definitely worth the effort. When you’ve got a historical past of injuries, your charges can be upper.

Location Inside Toledo

Even your location inside of Toledo can affect your insurance coverage premiums. Spaces with upper crime charges or twist of fate frequency have a tendency to have upper insurance coverage prices. It’s because insurers take note the precise menace elements related to each and every location when figuring out your charges. Should you are living in a high-risk space, be expecting just a little further for your premiums.

Desk of Elements Influencing Premiums

| Issue | Description | Have an effect on on Top rate | Instance |

|---|---|---|---|

| Using Behavior | Competitive using, injuries, violations | Upper premiums | Widespread dashing tickets result in upper charges. |

| Automobile Sort | Top-performance, pricey automobiles | Upper premiums | A sports activities automotive will most probably have a better top class than a typical sedan. |

| Using Historical past | Injuries, violations, claims | Upper premiums | A driving force with a contemporary twist of fate can have a better top class. |

| Location | Top-crime spaces, accident-prone zones | Upper premiums | Residing close to a heavy-traffic intersection might impact your charge. |

Evaluating Insurance coverage Firms in Toledo

Selecting the correct automotive insurance coverage in Toledo, OH, can really feel like navigating a maze. Other corporations be offering other offers, and understanding who is the most efficient have compatibility on your wishes may also be tough. Realizing the strengths and weaknesses of each and every participant within the sport is secret to meaking an educated resolution.Figuring out the quite a lot of insurance coverage corporations’ protection, reputations, and customer support help you make a selection correctly.

This comparability will dive deep into the specifics, offering a clearer image of your choices within the Toledo marketplace.

Protection Presented by means of Other Suppliers

Other insurance coverage corporations tailor their protection applications to fit quite a lot of using kinds and wishes. Some might be offering complete applications with added extras, whilst others would possibly focal point on fundamental prerequisites. Figuring out the specifics of each and every coverage is an important prior to committing to a plan. It is like evaluating other flavors of ice cream – you may in finding one corporate’s protection as wealthy and decadent, whilst some other gives a lighter, refreshing possibility.

Popularity and Reliability of Primary Firms

Insurance coverage corporations in Toledo, like in all places else, have various reputations. Elements like claims dealing with pace, monetary balance, and buyer evaluations all give a contribution to an organization’s general status. A powerful popularity incessantly interprets to smoother claims processes and peace of thoughts for policyholders. Some corporations would possibly have a historical past of being extremely responsive, whilst others could be recognized for extra protracted declare settlements.

Take a look at unbiased evaluations to get a well-rounded point of view.

Strengths and Weaknesses of Each and every Corporate

Each and every insurance coverage corporate has its distinctive set of strengths and weaknesses. Some would possibly excel in offering reasonably priced charges, whilst others might prioritize customized customer support. Inspecting those nuances help you in finding the corporate that absolute best aligns together with your priorities. As an example, one corporate could be famend for its fast declare processing, however some other would possibly have a decrease top class.

Discovering the perfect steadiness is essential to securing a coverage that matches your wishes.

Buyer Provider High quality

Customer support is an crucial facet when opting for an insurance coverage corporate. The standard of carrier can vary from responsive and useful brokers to irritating and inefficient interactions. Imagine how necessary very good buyer beef up is to you. Some corporations are praised for his or her attentive brokers and urged responses, whilst others would possibly fight with conversation or dealing with inquiries.

Buyer Opinions and Examples

Studying buyer evaluations is a treasured technique to get a firsthand take a look at an organization’s functionality. Opinions can give insights into claims dealing with, coverage readability, and the full buyer revel in. As an example, an organization would possibly obtain many sure feedback for its fast claims processing, but additionally some lawsuits about complicated coverage wording.

Comparability Desk of Insurance coverage Firms

| Insurance coverage Corporate | Protection Highlights | Buyer Provider Ranking | Monetary Balance |

|---|---|---|---|

| Innovative | Aggressive charges, on-line gear, excellent for younger drivers | 4.5 out of five stars (in line with reasonable on-line evaluations) | Superb; persistently excessive monetary scores |

| State Farm | Wide selection of goods, in depth community, recognized for native presence | 4.2 out of five stars (in line with reasonable on-line evaluations) | Very sturdy monetary balance |

| Allstate | Gives complete plans, claims dealing with varies by means of area | 3.8 out of five stars (in line with reasonable on-line evaluations) | Forged monetary status |

| Geico | In most cases decrease charges, virtual platform is user-friendly | 4.0 out of five stars (in line with reasonable on-line evaluations) | Sturdy monetary balance, persistently excessive scores |

Guidelines for Discovering Reasonably priced Automobile Insurance coverage in Toledo

Discovering the proper automotive insurance coverage in Toledo, OH, can really feel like navigating a maze. However concern no longer, squad! With just a little expertise, you’ll snag a killer deal and avoid wasting critical moolah. This information breaks down the methods to attain the most efficient charges on the town.Automobile insurance coverage charges in Toledo, like maximum puts, are influenced by means of a number of things.

Figuring out those components empowers you to make good alternatives and probably decrease your top class. Sensible strikes incessantly result in main financial savings.

Evaluating Quotes from Other Suppliers

Evaluating quotes from quite a lot of insurance coverage corporations is an important. Other suppliers have other pricing fashions and protection choices. This comparability procedure is essential to securing the most efficient conceivable charge. On-line comparability gear are an enormous lend a hand on this procedure.

- Use on-line comparability gear: Those platforms accumulate quotes from a couple of insurers, making the method tremendous environment friendly. You’ll be able to enter your main points as soon as, and get quotes from quite a lot of corporations. This manner, you do not have to touch each and every corporate in my view. It is a general time-saver and a good move.

- Request a couple of quotes: Do not settle for only one quote. Get quotes from a minimum of 3 to 5 other insurers. This permits for a broader comparability, enabling you to spot probably the most aggressive charge. This can be a easy however efficient technique.

- Imagine other protection ranges: You could no longer want probably the most complete protection. Analyze your wishes and make a selection the protection that matches your price range and way of life. That is an important for minimizing pointless bills.

Bundling Insurance coverage Merchandise

Bundling your automotive insurance coverage with different insurance coverage merchandise, like house or renters insurance coverage, can incessantly lead to important reductions. This can be a strategic transfer for saving cash. Insurers incessantly praise consumers who package their insurance policies.

- Blended insurance policies incessantly be offering reductions: Many insurers be offering reductions while you package your automotive insurance coverage with different insurance policies. It is like getting an advantage on your insurance coverage savvy. That is an improbable means to save cash.

- Test for bundling choices: Touch other insurers and inquire about their bundling choices and doable reductions. Do not hesitate to invite about those alternatives.

Leveraging Reductions and Gives

Reductions and particular gives are your allies achieve reasonably priced automotive insurance coverage. Profit from them to scale back your per 30 days top class. Reductions are continuously to be had for quite a lot of elements.

- Excellent using behavior incessantly result in reductions: Many insurers be offering reductions for protected drivers. That is a right away mirrored image of your accountable using behavior. This can be a nice incentive to power safely.

- Reductions for positive demographics or traits: Some insurers be offering reductions for college kids, senior voters, or explicit professions. Those can range very much, and you’ll profit from them in the event you qualify.

- Insurance coverage corporations incessantly run promotions: Keep knowledgeable about promotions and reductions out of your most popular insurers. Stay your eyes peeled for any offers that can scale back your automotive insurance coverage prices.

The usage of On-line Comparability Equipment

On-line comparability gear are priceless sources for locating the most efficient automotive insurance coverage charges. Those gear streamline the quote-gathering procedure. They supply a snappy and simple technique to examine quotes.

- Successfully examine quotes from quite a lot of corporations: On-line gear routinely accumulate quotes from a couple of insurance coverage suppliers. This can be a large time-saver and a treasured technique to in finding the most efficient offers.

- Save effort and time: Those gear do away with the will for handbook analysis and comparisons. It is a game-changer for the ones in quest of reasonably priced automotive insurance coverage.

Figuring out Explicit Coverages

Yo, long term drivers in Toledo! Navigating automotive insurance coverage can really feel like deciphering historical hieroglyphs, however it is utterly manageable. Figuring out the other coverages is essential to getting the proper coverage on your experience and your pockets. Let’s damage it down, so you are no longer simply paying for insurance coverage, you are getting the bang on your dollar.Realizing your coverages will provide you with the reassurance to cool and benefit from the experience.

It is like having a security internet—you recognize precisely what is coated and what is no longer, so you’ll steer clear of any sudden surprises down the street.

Legal responsibility Protection

Legal responsibility protection is principally your insurance coverage’s promise to pay for damages you reason to others in an twist of fate. It is like a security internet for the opposite driving force, their automotive, or any person else harm within the crash. Bring to mind it as monetary coverage if you are at fault.

- This protection kicks in if you find yourself answerable for inflicting an twist of fate and harming anyone else or their assets. It covers the opposite particular person’s scientific expenses, automobile restore prices, and different damages, as much as your coverage limits.

As an example, in the event you rear-end some other automotive and reason $5,000 in damages, your legal responsibility protection would step in to hide the ones prices. Vital to bear in mind: Legal responsibility protection

does not* give protection to your individual automobile otherwise you within the twist of fate.

Collision Protection

Collision protection protectsyour* automotive if it will get broken in an twist of fate, irrespective of who is at fault. That is tremendous an important, particularly if you are financing your experience or simply wish to steer clear of a hefty restore invoice.

- This protection will pay for the maintenance or substitute of your automobile if it is considering a collision. It is activated although

-you’re* at fault.

Shall we embrace you are in a fender bender and your automotive wishes $2,000 in maintenance. Your collision protection will quilt the ones maintenance, ensuring your automotive is again at the highway with out an enormous monetary hit.

Complete Protection

Complete protection is your backup plan for non-collision injury on your automotive. This covers a large number of issues past simply injuries, like vandalism, fireplace, robbery, and even falling items.

- This protection will pay for damages on your automobile led to by means of occasions

-other* than a collision, like robbery, hail injury, or perhaps a tree falling for your automotive.

As an example, if anyone vandalizes your automotive and scratches the paint, complete protection can lend a hand pay for the maintenance. It is like having an additional layer of coverage on your funding.

Uninsured/Underinsured Motorist Protection

This protection is your protection internet if you are considering an twist of fate with anyone who does not have sufficient insurance coverage or no insurance coverage in any respect. It is vital on your coverage, particularly in a town like Toledo with a large number of drivers at the highway.

- This protection steps in if you are considering an twist of fate with a driving force who has inadequate or no insurance coverage. It will pay on your damages and scientific bills, as much as your coverage limits.

Believe coming into an twist of fate with a driving force who does not have insurance coverage. Your uninsured/underinsured motorist protection would give protection to you from the monetary fallout, serving to quilt your scientific expenses and automobile maintenance. It is a essential defend with regards to such unlucky incidents.

Native Sources for Automobile Insurance coverage Data

Discovering the proper automotive insurance coverage in Toledo, OH, can really feel like navigating a maze. However do not sweat it! There are many dependable sources that will help you in finding the most efficient deal with out getting misplaced within the bureaucracy. Realizing the place to appear makes an enormous distinction, particularly if you are searching for a deal that matches your price range.

Dependable Sources for Data

Toledo has a wealth of sources that will help you examine and make a selection the proper automotive insurance coverage. Those vary from respectable executive our bodies to unbiased comparability websites, all designed to make your seek smoother. Using those sources can save you time and cash, making sure you get the most efficient conceivable protection.

Native Shopper Coverage Companies

Native client coverage companies play an important position in making sure truthful remedy for shoppers. They act as a watchdog, investigating lawsuits and offering beef up when essential. Those companies are very good sources for resolving disputes or problems with insurance coverage corporations. They are able to additionally be offering treasured data for your rights and obligations as a policyholder.

Unbiased Insurance coverage Comparability Web pages

A large number of on-line comparability gear are to be had, providing a snappy and simple technique to examine quotes from quite a lot of insurance coverage corporations. Those websites incessantly let you filter out by means of protection wishes, using historical past, and automobile kind. This streamlined method may also be specifically useful to find reasonably priced choices adapted on your explicit state of affairs. As an example, websites like Insurify or Policygenius incessantly supply detailed comparisons, permitting you to pick out the coverage that most nearly fits your own necessities.

Respected Native Insurance coverage Brokers

Native insurance coverage brokers be offering a personalized effect within the automotive insurance coverage procedure. They act as a bridge between you and a couple of insurance coverage suppliers, offering skilled steering and adapted suggestions. Running with an area agent permits you to ask explicit questions and get adapted recommendation. They are able to let you perceive the other coverages and in finding the most efficient choices on your distinctive wishes.

Checking with the Higher Trade Bureau or native client coverage teams help you determine respected brokers on your space. Search for brokers who’ve a confirmed observe report of offering very good customer support. As an example, you may in finding tips about on-line boards or via word-of-mouth referrals.

Ultimate Ideas: Automobile Insurance coverage In Toledo Ohio

In conclusion, securing reasonably priced and complete automotive insurance coverage in Toledo, Ohio, comes to cautious attention of things like using behavior, automobile kind, and placement. Evaluating quotes from a couple of suppliers, figuring out other protection sorts, and leveraging to be had reductions are crucial steps on this procedure. Using native sources and in quest of recommendation from respected insurance coverage brokers can additional strengthen your decision-making. This information has equipped a framework for figuring out the specifics of auto insurance coverage in Toledo, enabling knowledgeable alternatives on your monetary coverage.

Continuously Requested Questions

What are the most typical reductions to be had for automotive insurance coverage in Toledo?

Not unusual reductions come with the ones for protected using data, bundling a couple of insurance policies (house and auto), and for anti-theft gadgets. Reductions additionally incessantly practice to scholars, senior voters, and those that take part in defensive using classes.

How does my using report impact my insurance coverage top class in Toledo?

A blank using report in most cases ends up in decrease premiums. Injuries and visitors violations can considerably build up your charges. The severity of the violation and the frequency of offenses play a vital position in top class calculation.

What are the everyday automotive insurance coverage wishes of drivers in Toledo, OH?

Drivers in Toledo, like the ones national, in most cases want legal responsibility protection to give protection to them from doable claims bobbing up from injuries. Collision and complete protection supply coverage towards injury to their very own automobiles, and uninsured/underinsured motorist protection is an important for cover towards injuries involving drivers with insufficient or no insurance coverage.

Are there any explicit client coverage companies in Toledo for automotive insurance coverage problems?

Whilst explicit Toledo client coverage companies for insurance coverage will not be widely recognized, there are possibly state-level companies that supply sources and help in resolving insurance-related disputes.