Is hole insurance coverage price it on a used automobile? This vital query haunts many used automobile patrons, a perplexing predicament challenging cautious attention. Working out the nuances of hole insurance coverage and its implications for used automobiles is very important ahead of creating a dedication. The price proposition relies closely at the automobile’s situation, acquire value, and attainable for depreciation. This complete information will get to the bottom of the complexities, serving to you resolve if this often-overlooked protection is in point of fact important to your used automobile funding.

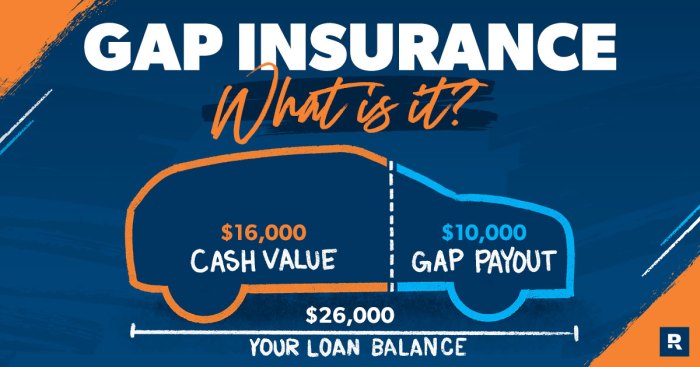

Used vehicles, usally bargains, can also be topic to unexpected instances. A collision or overall loss can hastily go away you with a considerable monetary burden, probably exceeding the automobile’s present marketplace price. Hole insurance coverage acts as a security web, stepping in to hide the variation between the mortgage quantity and the automobile’s depreciated price. Navigating this intricate internet of things is secret to meaking an educated resolution.

Working out Hole Insurance coverage

Marga ni hole insurance coverage, sada usaha na ringgas jala penting i bas jaman na on. I bas sektor otomotif, hole insurance coverage mambahen perlindungan tambahan i bas situasi na mungkin terjadi. Ingkon dipahami ma na mungkin terjadi, agar dapat diantisipasi.

Definition and Objective

Hole insurance coverage merupakan jenis asuransi tambahan yang melindungi selisih antara nilai pasar kendaraan dan nilai utang yang belum dilunasi. Hal ini penting, terutama untuk pembelian mobil bekas, karena nilai mobil bekas cenderung menurun seiring waktu. Hole insurance coverage bekerja dengan cara membayar selisih tersebut jika terjadi kerugian overall atau pencurian. Jadi, walaupun mobil sudah rusak overall atau dicuri, pemegang polis tetap akan mendapatkan pengembalian sejumlah utang yang belum dilunasi.

Ini merupakan perlindungan tambahan terhadap kemungkinan kerugian finansial yang mungkin timbul.

Distinction from Different Car Insurance coverage

Hole insurance coverage berbeda dengan asuransi kendaraan lain seperti complete dan collision. Asuransi complete dan collision umumnya hanya menanggung kerusakan fisik kendaraan, sedangkan hole insurance coverage fokus pada perlindungan terhadap utang yang belum dilunasi. Hole insurance coverage tidak menutupi kerusakan fisik, melainkan selisih nilai antara harga beli dan utang. Asuransi kendaraan lain fokus pada perbaikan atau penggantian kendaraan, sementara hole insurance coverage fokus pada pelunasan utang.

Situations Requiring Hole Insurance coverage

Hole insurance coverage sangat penting dipertimbangkan dalam beberapa situasi pembelian mobil bekas. Jika Anda membeli mobil bekas dengan pinjaman, dan nilai mobil tersebut menurun drastis, hole insurance coverage akan membantu melindungi Anda dari kerugian finansial jika terjadi kerusakan overall atau pencurian. Misalnya, jika Anda membeli mobil bekas seharga Rp100 juta dengan utang Rp80 juta, dan mobil tersebut mengalami kecelakaan overall, asuransi hole insurance coverage akan melunasi utang tersebut.

Dengan demikian, Anda tidak perlu menanggung kerugian finansial yang cukup besar.

Comparability Desk

| Situation | Hole Insurance coverage Protection |

|---|---|

| Membeli mobil bekas dengan pinjaman, dan nilai mobil menurun drastis. | Melindungi selisih antara nilai mobil saat pembelian dan nilai utang yang belum dilunasi. |

| Mobil mengalami kerusakan overall akibat kecelakaan. | Membantu melunasi utang mobil yang belum dilunasi. |

| Mobil dicuri. | Membantu melunasi utang mobil yang belum dilunasi. |

| Mobil mengalami kerusakan berat dan tidak layak pakai. | Membantu melunasi utang mobil yang belum dilunasi, jika nilai mobil sudah tidak mencukupi untuk melunasi utang. |

Elements Affecting Hole Insurance coverage Price

Marga ni, di naeng marende, angka faktor na manggutuhi nilai asuransi hole di mobil terpakai. Penting siboan na mambagi di hita asa boi dipahami naeng manang pe gabe penting naeng manjalo asuransi hole. Ikkon dipatoguhon jala dipahami faktor-faktor na manggutuhi nilai asuransi hole asa boi diputushon secara tepat.

Car Age and Mileage

Usia dohot jarak tempuh mobil mambahen pengaruh signifikan tu kebutuhan asuransi hole. Mobil na umbotosa usiana, umbalos jarak tempuh, jotjotna umbalos nilai tukar. Hal on mambahen kemungkinan “hole” di antara nilai pasar dohot nilai asuransi mobil na umbotosa. Mobil na umbotosa usiana, umbalos kemungkinan depresiasi, jadi penting dipertimbangkan faktor on.

Unique Acquire Value

Harga beli awal mobil mambahen pengaruh penting tu kemungkinan “hole”. Mobil na umbalos harga belina, umbalos kemungkinan “hole” antara harga beli dohot nilai tukar. Penting diingat bahwa harga beli awal bukanlah satu-satunya faktor. Faktor-faktor na asing, songon umur mobil dohot kondisi mobil pe mambahen pengaruh.

Industry-in Price and Depreciation

Nilai tukar dohot depresiasi mobil mambahen pengaruh penting tu kebutuhan asuransi hole. Jotjotna, nilai tukar mobil na umbotosa usiana, umbalos. Depresiasi dohot nilai tukar na rendah mambahen kemungkinan “hole” umbalos. Penting diingat bahwa nilai tukar dohot depresiasi gabe faktor na dinamis, jala boi berubah-ubah sesuai kondisi pasar.

Examples of Used Automotive Situations

| Car Age | Mileage | Acquire Value | Industry-in Price | Hole Insurance coverage Advice |

|---|---|---|---|---|

| 3 years | 30,000 km | Rp 200 juta | Rp 150 juta | Strongly really useful. |

| 5 years | 50,000 km | Rp 180 juta | Rp 120 juta | Really helpful. |

| 7 years | 70,000 km | Rp 150 juta | Rp 90 juta | Really helpful, however imagine in moderation. |

| 10 years | 100,000 km | Rp 120 juta | Rp 60 juta | Most likely now not really useful, tergantung kondisi mobil. |

Tabel on mambagi contoh-contoh skenario mobil terpakai dohot kemungkinan kebutuhan asuransi hole, dibahen sesuai umur, jarak tempuh, harga beli awal, dohot nilai tukar. Penting dipahami bahwa on hanyalah contoh-contoh, jala kebutuhan asuransi hole di setiap kasus berbeda-beda.

Comparing the Price-Advantage of Hole Insurance coverage

Marga ni, working out the monetary implications of hole insurance coverage on a used automobile is the most important. It isn’t with reference to the preliminary charge; it is about weighing the prospective financial savings towards the top rate paid. This phase delves into the cost-benefit research, inspecting eventualities the place hole insurance coverage is a valid funding and when its expense outweighs the prospective go back.

Evaluating Prices and Possible Financial savings

Figuring out the worth of hole insurance coverage comes to a cautious comparability of the insurance coverage top rate towards the prospective financial savings in case of a complete loss or vital injury. The top rate is a hard and fast charge, whilst the prospective financial savings are contingent on the real price of the auto and the level of wear and tear. Elements like marketplace depreciation, coincidence severity, and the auto’s situation play a vital position within the equation.

Scenarios The place Hole Insurance coverage is Profitable

Hole insurance coverage generally is a prudent selection in numerous eventualities. A main instance is when the auto’s marketplace price considerably depreciates beneath the phenomenal mortgage quantity. If the auto is broken past restore, the insurance coverage payout would possibly not duvet the total mortgage, leaving a considerable shortfall. Hole insurance coverage would bridge this distinction, protective the consumer from monetary loss.

Moreover, a automobile excited about an coincidence that leads to a complete loss would get pleasure from hole insurance coverage. In such cases, the insurance coverage proceeds would possibly now not absolutely catch up on the mortgage quantity.

Scenarios The place the Price Outweighs the Get advantages

There also are eventualities the place the price of hole insurance coverage would possibly not justify the prospective advantages. As an example, if the auto’s price stays with reference to the mortgage quantity, the prospective financial savings from hole insurance coverage could be minimum. Moreover, if the consumer has a vital quantity of fairness within the automobile, the desire for hole insurance coverage is decreased. Additionally, if the consumer has enough non-public financial savings to hide any shortfall within the match of a complete loss, the price of hole insurance coverage is also thought to be useless.

Situation-Based totally Research of Hole Insurance coverage Software

The next desk illustrates how hole insurance policy applies in quite a lot of eventualities of auto injury. It highlights the instances the place hole insurance coverage would provide coverage and the ones the place its charge is also over the top.

| Injury Sort | Hole Insurance coverage Protection | Price Research |

|---|---|---|

| Minor fender bender (restore charge not up to depreciated price) | No protection | Hole insurance coverage premiums aren’t recovered. |

| Overall loss because of hearth or flood | Complete protection (covers the variation between the automobile’s price and the phenomenal mortgage) | Vital financial savings if the mortgage quantity exceeds the automobile’s price. |

| Overall loss because of coincidence (mortgage quantity exceeds automobile’s price) | Complete protection (covers the variation between the automobile’s price and the phenomenal mortgage) | Vital financial savings, protective towards monetary loss. |

| Main coincidence, automobile repairable (mortgage quantity with reference to automobile’s price) | No protection | Minimum advantage because the mortgage quantity is with reference to the automobile’s price, making the price of hole insurance coverage over the top. |

| Automotive is stolen and entirely recovered (mortgage quantity with reference to automobile’s price) | Complete protection | Vital financial savings, because it covers the variation between the automobile’s price and the phenomenal mortgage. |

Choices to Hole Insurance coverage

Marga naposo ni Tuhan, dibahen hita mamahaman taringot tu alternatif na asing sian asuransi hole asa unang mansai torang jala jelas. Adong alternatif na asing na boi dipake laho mangalului perlindungan, jala paboaon ma dison cara mangalului perlindungan na asing i.

Further Automotive Insurance coverage Protection

Penting ma patuduhonon taringot tu alternatif na asing, asa boi dipahami secara komprehensif. Asuransi mobil komprehensif marlapatan na mencakup kerusakan mobil akibat kejadian tak terduga, seperti tabrakan, pencurian, atau bencana alam. Asuransi komprehensif boi mangalului perlindungan di hal na mungkin tidak tercakup di dalam asuransi hole. I dohot i, asuransi komprehensif pe boi mangurupi di kasus-kasus tertentu, na boi mangganti kerugian na di alami.

Negotiating a Decrease Value

Boi do dipahami, laho mangalului alternatif na asing sian asuransi hole, boi do diusahahon marunding jala mandapatkan harga yang lebih murah di saat membeli mobil bekas. Mungkin saja, pemilik mobil bekas boi setuju mangurangi harga mobil na di jual, jala hita boi mambuat keputusan di tingki na tepat. Mungkin, di tingki marunding, boi dibahen tawaran na asing.

Prolonged Guaranty

Asuransi ekstensi garansi boi do dipake laho mangalului alternatif na asing sian asuransi hole. Ekstensi garansi marlapatan na mangalului perlindungan di komponen mobil na mungkin rusak. Na boi mangganti biaya perbaikan di masa depan, jala mangurupi di hal na mungkin tidak tercakup di dalam asuransi hole. Na penting diingat, ekstensi garansi boi mangurupi di hal na mungkin terjadi di masa depan, tapi tidak seluruh kasus na mungkin terjadi.

Comparability Desk: Hole Insurance coverage vs. Complete Protection

| Function | Hole Insurance coverage | Complete Protection |

|---|---|---|

| Protection | Menutupi selisih antara nilai pasar mobil dan jumlah utang | Menutupi kerusakan atau kehilangan mobil akibat kejadian tak terduga, seperti kecelakaan, pencurian, atau bencana alam |

| Price | Biaya tambahan, biasanya dihitung sebagai premi | Biaya tambahan dihitung sebagai premi asuransi mobil |

| Protection for Depreciation | Secara khusus menutupi depresiasi | Tidak secara khusus menutupi depresiasi, tetapi boi mencakup hal na mungkin terjadi |

| Protection for Robbery | Mencakup pencurian | Mencakup pencurian |

| Protection for Injuries | Tidak secara langsung mencakup kecelakaan | Mencakup kerusakan akibat kecelakaan |

Illustrative Examples of Hole Insurance coverage

Di dunia mobil bekas, memahami pentingnya asuransi hole merupakan kunci untuk melindungi investasi Anda. Asuransi ini dapat memberikan perlindunga tambahan ketika terjadi hal tak terduga, seperti kecelakaan atau kerusakan overall pada kendaraan Anda. Berikut ini beberapa contoh nyata yang akan membantu Anda memahami manfaatnya.

Situation of Prime Get advantages

Bayangkan Anda membeli mobil bekas dengan harga Rp 150 juta. Nilai pasar mobil itu saat ini sekitar Rp 100 juta. Jika terjadi kecelakaan dan mobil mengalami kerusakan overall, asuransi kendaraan Anda mungkin hanya membayar Rp 90 juta. Dengan demikian, Anda akan mengalami kerugian sebesar Rp 10 juta. Namun, dengan asuransi hole, Anda akan mendapatkan tambahan dana hingga mencapai harga pembelian mobil, mengurangi kerugian yang Anda alami.

Ini sangat membantu Anda menutupi selisih harga antara harga beli dan nilai yang dibayarkan oleh asuransi.

Situation of Restricted Want

Sebaliknya, bayangkan Anda membeli mobil bekas dengan harga Rp 80 juta. Nilai pasarnya saat ini sekitar Rp 70 juta. Jika terjadi kerusakan overall, asuransi kemungkinan besar akan membayar nilai yang mendekati harga pasar, yakni Rp 70 juta. Perbedaannya, hanya Rp 10 juta. Dalam kasus ini, asuransi hole mungkin tidak terlalu krusial, karena kerugian finansial yang mungkin terjadi relatif kecil.

Perlu dipertimbangkan apakah biaya premi asuransi hole sebanding dengan potensi kerugian yang mungkin dialami.

Complete Instance of Overall Loss

Misalkan Pak Budi membeli mobil bekas tahun 2018 dengan harga Rp 200 juta. Nilai pasar mobil tersebut saat ini hanya Rp 150 juta. Karena suatu kecelakaan, mobil Pak Budi mengalami kerusakan overall. Asuransi kendaraan hanya membayar Rp 140 juta. Tanpa asuransi hole, Pak Budi akan mengalami kerugian sebesar Rp 60 juta (Rp 200 juta – Rp 140 juta).

Dengan asuransi hole, Pak Budi akan menerima tambahan dana hingga mencapai harga pembelian mobil, yaitu Rp 200 juta. Ini berarti kerugian finansial Pak Budi akan berkurang signifikan, membantu mengurangi dampak finansial akibat kerusakan overall kendaraan.

Mitigation of Monetary Loss

Asuransi hole berperan penting dalam meringankan beban finansial ketika terjadi kerusakan overall pada mobil bekas. Dengan menutupi selisih antara harga beli dan nilai yang dibayarkan asuransi, asuransi hole membantu meminimalkan kerugian dan memastikan bahwa Anda tetap terlindungi secara finansial. Sebagai ilustrasi, jika asuransi hole tidak ada, kerugian finansial dapat mencapai angka yang signifikan, berpotensi membuat Anda mengalami kesulitan finansial.

Addressing Possible Misconceptions: Is Hole Insurance coverage Value It On A Used Automotive

Marga ni, naeng, hita mangalusi mauliatehon di angka salah paham taringot tu asuransi hole di mobil terpakai. Asa holan angka na denggan do na taingot, asa unang adong na salah paham.Sada hal na ringkot sipahami ma, asuransi hole ndang songon asuransi mobil na biasa. Asuransi hole holan mambahen angka kerugian ni mobil, molo terjadi kecelakaan. I do na ringkot dipadomu.

Asa unang ma adong na salah paham, naeng sipahami ma.

Not unusual Misconceptions Referring to Hole Insurance coverage, Is hole insurance coverage price it on a used automobile

Marhite sian pengalaman ni angka na ummuli, adong ma angka salah paham taringot tu asuransi hole na ringkot sipatahi ma. Disi, marhite pamingkiron na benar do, hita mampu mangalusi mauliatehon di angka salah paham i.

- Hole insurance coverage is necessary for all used vehicles.

Ndang songon i. Asuransi hole ndang wajib di pakai di setiap mobil terpakai. I do na benar. Asuransi hole maruntung di keadaan tertentu, jala ndang setiap mobil terpakai mangkilala keuntungan i.

- Hole insurance coverage is at all times advisable.

Ndang selalu. Adong keadaan dimana asuransi hole ndang memberikan keuntungan. Misalnya, molo harga mobil terpakai i tarpatolhas. Di situasi na songon i, asuransi hole mungkin ndang perlu.

- Hole insurance coverage covers all damages.

Ndang. Asuransi hole holan mambahen kerugian mobil na melebihi nilai pasaran ni mobil. Asuransi mobil na biasa do na mambahen kerugian di kecelakaan. Asa unang ma salah paham.

Scenarios The place Hole Insurance coverage Would possibly No longer Be Really helpful

Adong situasi na mungkin ndang perlu di pakai asuransi hole. Di situasi i, mungkin hita mampu mangalusi mauliatehon marhite pengalaman ni angka na ummuli.

- The automobile’s present marketplace price is with reference to or equivalent to the mortgage quantity.

- The automobile has a low marketplace price.

- The automobile could be very outdated and has low residual price.

- The mortgage time period is brief.

Di situasi i, asuransi hole ndang pasti memberikan keuntungan na nyata. Hita pe butuh mempertimbangkan biaya na di perluhon untuk asuransi hole.

Why Hole Insurance coverage Is not At all times Essential

Hole insurance coverage, mungkin ndang dibutuhkan di setiap keadaan. Mungkin maruntung di keadaan na tertentu, jala ndang setiap mobil terpakai mangkilala keuntungan i.

- Monetary prudence. Hita mampu mangalusi mauliatehon di biaya na tambahan, asa hita dapat mempertimbangkan angka alternatif.

- Prime deductible. Asuransi mobil na biasa do na mambahen angka kerugian na besar, molo terjadi kecelakaan.

Na ringkot do diingat, keputusan na tepat do na mambahen hita mampu mangalusi mauliatehon di kondisi na berbeda.

Abstract

In the end, deciding whether or not hole insurance coverage is worthwhile on a used automobile hinges in your person instances. Completely comparing the automobile’s situation, attainable depreciation, and monetary scenario are paramount. Bearing in mind possible choices, like adjusting the mortgage quantity or exploring complete protection choices, could also be sensible. This detailed exploration of hole insurance coverage on used vehicles empowers you to make an educated, financially sound selection.

Through working out the prospective advantages and disadvantages, you’ll be able to optimistically give protection to your funding and safeguard your self from monetary surprises.

Questions and Solutions

Is hole insurance coverage necessary for all used vehicles?

No, hole insurance coverage isn’t necessary. It is a supplemental protection possibility, now not a demand.

How does hole insurance coverage paintings with complete protection?

Complete protection usally overlaps with some facets of hole insurance coverage. Alternatively, they’re distinct and usally deal with other monetary dangers.

What are the typical misconceptions about hole insurance coverage?

A not unusual false impression is that hole insurance coverage is at all times a important acquire. This isn’t at all times the case. The price proposition hinges in your explicit instances and the automobile’s attainable for depreciation.

Can I negotiate the space insurance coverage charge?

Sure, you’ll be able to every so often negotiate the space insurance coverage top rate with the lender or insurance coverage supplier.