Can I am getting USAA automobile insurance coverage for my female friend’s automobile? This can be a commonplace query, particularly if you are searching for reasonably priced and dependable protection. It is utterly comprehensible to need the most efficient deal, however USAA has particular regulations about insuring somebody else’s trip. So, let’s dive into the nitty-gritty main points, working out if it is even conceivable and what you want to grasp.

Mainly, USAA is a sexy cool insurance coverage choice, however it is not at all times a simple sure or no in terms of protecting a non-member’s automobile. Such things as your female friend’s using document, the auto’s situation, and the place she parks all of it play a task. Let’s smash it down, we could?

Eligibility Standards: Can I Get Usaa Automotive Insurance coverage For My Female friend’s Automotive

USAA automobile insurance coverage, whilst essentially designed for individuals of the US Auto Affiliation, does from time to time be offering protection to non-members below particular instances. Working out those standards is an important for figuring out if protection is a viable choice for a non-member’s car.

USAA Eligibility Necessities for Non-Contributors

USAA’s insurance policies for non-members are considerably other from the ones for relations. Protection is in most cases restricted and calls for a compelling reason why for attention past the standard instances. The important thing components influencing eligibility for a non-member’s car are ceaselessly the applicant’s present courting with USAA, the car’s traits, and the specific instances of the appliance.

Elements Influencing Eligibility

A number of components affect the eligibility of a non-member’s car for USAA insurance coverage. Those components are assessed holistically to resolve if the applicant meets the factors for attention.

- Courting with USAA: A pre-existing courting with USAA, similar to a previous insurance coverage or an important monetary courting, would possibly build up the possibilities of approval. As an example, a non-member who has been a USAA financial institution buyer for years may well be considered extra favorably than a fully new applicant.

- Car Traits: The car’s make, style, yr, and worth can have an effect on eligibility. USAA would possibly have restrictions on particular forms of automobiles or fashions. Elements such because the car’s historical past and upkeep information also are ceaselessly thought to be.

- Software Cases: The particular causes for desiring protection for a non-member’s car would possibly affect eligibility. A transparent and compelling reason behind the will, similar to a short lived want for protection or a novel scenario, would possibly build up the possibility of approval.

Making use of for Protection

The method for making use of for protection for a non-member’s car varies from the usual USAA software process. Detailed details about the car, the applicant, and the precise want for protection is very important.

- Detailed Data: Entire and correct details about the car and the applicant is needed. This will likely come with the car id quantity (VIN), the applicant’s using document, and any related monetary data.

- Software Submission: The appliance procedure is normally carried out thru a devoted channel or shape designed for non-members. A whole software, together with supporting paperwork, is important for processing.

- Evaluation and Approval: USAA moderately critiques each and every software, making an allowance for all components. The assessment procedure would possibly take a while. The applicant will obtain notification of the verdict in regards to the software.

Restrictions and Boundaries

There are probably restrictions and obstacles on protection for non-member automobiles. Those would possibly come with coverage limits, exclusions, or particular phrases and stipulations. A cautious assessment of the main points and fantastic print is really useful.

- Coverage Limits: The protection quantity for non-member automobiles is also not up to for a member’s car. This restrict is also in keeping with the car’s price or the applicant’s instances.

- Exclusions: Sure forms of protection may well be excluded or have obstacles for non-member automobiles. Those exclusions may just observe to express actions or situations.

- Phrases and Prerequisites: Non-member insurance policies will most likely have other phrases and stipulations in comparison to insurance policies for USAA individuals. Those stipulations may just come with deductibles, top class charges, and different main points.

Comparability of Eligibility Laws

The eligibility regulations for relations range considerably from the ones for non-family individuals. Members of the family ceaselessly have extra favorable remedy in relation to protection and get entry to to advantages.

- Circle of relatives Contributors: Members of the family in most cases take pleasure in extra favorable eligibility standards and ceaselessly have get entry to to broader protection choices.

- Non-Circle of relatives Contributors: Non-family individuals are assessed on a case-by-case foundation, and protection is normally extra restricted in comparison to USAA individuals or relations.

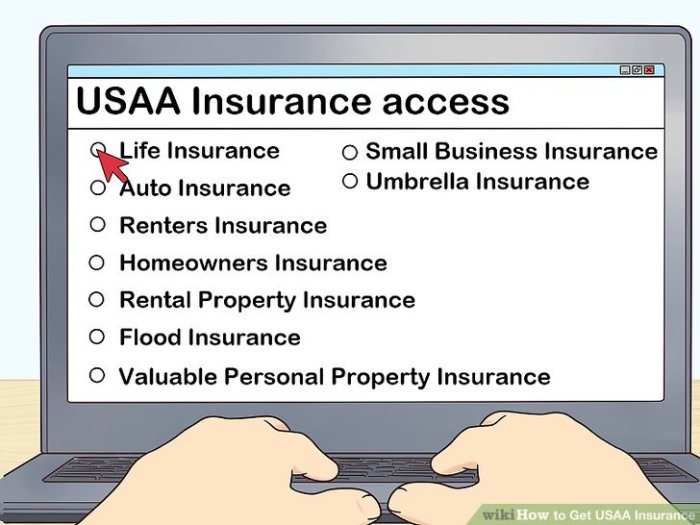

Insurance coverage Protection Choices

Securing suitable insurance policy is an important for safeguarding your female friend’s automobile. Working out the quite a lot of choices to be had and their related prices is essential for making an educated determination. This segment main points the various kinds of protection introduced via USAA, that specialize in the ones related to a non-member’s car, in conjunction with useful add-on choices.

Comparability of Automotive Insurance coverage Protection Choices

Other protection choices cater to various wishes and menace tolerances. A complete comparability is helping in opting for the correct mix of coverage.

| Protection Sort | Description | Top rate Implications |

|---|---|---|

| Legal responsibility Protection | Protects you if you are at fault for inflicting an coincidence, protecting the opposite driving force’s damages. | Usually the bottom top class, because it provides the least coverage. |

| Collision Protection | Covers harm on your car in an coincidence, without reference to who’s at fault. | Upper top class than legal responsibility, because it provides broader coverage. |

| Complete Protection | Protects in opposition to harm from occasions as opposed to collisions, like vandalism, robbery, or climate harm. | Top rate will increase with this protection, because it covers a much wider vary of doable dangers. |

| Uninsured/Underinsured Motorist Protection | Covers you if you are in an coincidence with a driving force who does not have insurance coverage or has inadequate protection. | Top rate will increase, because it safeguards in opposition to a an important hole in legal responsibility. |

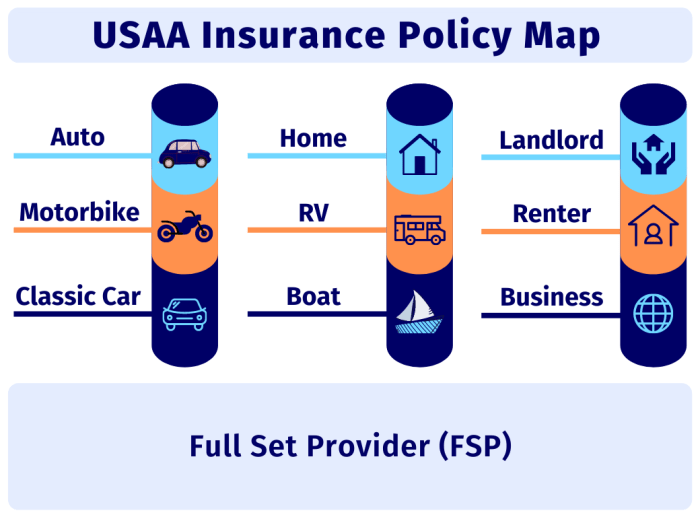

USAA Insurance coverage Protection for Non-Contributors

USAA, whilst essentially for individuals of america Armed Forces and their households, provides some protection choices for non-members. Those choices would possibly range in relation to particular main points and pricing from the usual insurance policies introduced to individuals. Crucially, particular main points and pricing is dependent upon the car and its historical past.

Upload-on Coverages

Sure add-on coverages can considerably make stronger the safety introduced via fundamental insurance coverage insurance policies.

- Roadside Help: Supplies lend a hand with flat tires, jump-starts, or lockouts. This protection may also be precious in sudden eventualities and in most cases comes at an extra charge.

- Apartment Automotive Protection: Covers the price of a apartment automobile in case your car is broken or interested in an coincidence requiring restore. This selection is especially really useful for those who depend closely on their automobile for transportation. The top class for apartment automobile protection varies in keeping with the duration of the apartment length and the apartment automobile’s day by day charge.

- Hole Insurance coverage: Covers the adaptation between the true money price of a car and its exceptional mortgage stability. That is really useful if the car is totaled and the mortgage quantity exceeds its price. It protects in opposition to monetary losses in such circumstances.

Deductibles and Protection Choices

Other protection choices ceaselessly include various deductibles. The deductible is the volume you pay out-of-pocket prior to the insurance coverage corporate begins protecting prices.

| Protection Possibility | Instance Deductibles |

|---|---|

| Collision Protection | $500, $1000, $2500, $5000 |

| Complete Protection | $500, $1000, $2500 |

| Uninsured/Underinsured Motorist Protection | $500, $1000, $2500 |

Observe: The particular deductibles and related prices will range relying on components such because the make, style, and yr of the auto, in addition to the motive force’s historical past and placement. A radical comparability of quotes from other insurers is really useful.

Top rate Calculation and Elements

Working out the criteria that affect automobile insurance coverage premiums is an important for making advised selections. This segment main points the important thing elements USAA, and different insurers, use to resolve the price of protection in your female friend’s car. Figuring out those components empowers you to evaluate the prospective bills and discover choices for doubtlessly decreasing premiums.

Elements Figuring out Automotive Insurance coverage Premiums

Quite a lot of components play a task in shaping the price of automobile insurance coverage. Those come with traits of the car, the motive force, and the using setting. A complete figuring out of those components is helping in making well-informed possible choices referring to insurance policy.

- Car Traits: The make, style, and yr of a car considerably have an effect on its insurance coverage top class. Cars perceived as extra liable to robbery or harm, or with complex options that can be pricey to fix, will in most cases command upper premiums. As an example, a high-performance sports activities automobile will most likely have the next top class in comparison to an ordinary sedan, because of upper restore prices and doable for injuries.

In a similar fashion, older automobiles with fewer security measures would possibly have upper premiums.

- Driving force Historical past: A driving force’s using document is a vital consider top class calculation. A blank using document with out a injuries or violations ends up in decrease premiums. Conversely, drivers with a historical past of injuries or site visitors violations face upper premiums to replicate the higher menace. A driving force with a couple of shifting violations, as an example, will most likely see the next top class in comparison to a driving force with a blank document.

- Car Location and Utilization: The positioning the place the car is essentially pushed and the frequency of its use additionally have an effect on the top class. Spaces with upper coincidence charges or upper robbery charges will in most cases have upper premiums. In a similar fashion, a car used for widespread long-distance using or for business functions would possibly have upper premiums than one used essentially for native journeys.

USAA Top rate Calculation for Non-Contributors

USAA, as a member-based group, employs a particular components for figuring out premiums. For non-members, the calculation procedure is in most cases very similar to different insurance coverage suppliers. This comes to an analysis of quite a lot of components to evaluate the danger related to insuring the car and driving force.

- Chance Review: USAA, and different corporations, assess the danger interested in insuring the car and the motive force in keeping with the criteria in the past mentioned. This comprises inspecting the motive force’s using historical past, the car’s make, style, and yr, and the positioning and utilization of the car. Refined algorithms are used to resolve the top class quantity.

- Top rate Calculation Formulation (Illustrative): Whilst the precise components is proprietary, it ceaselessly comes to a weighted reasonable of the quite a lot of menace components. As an example, a deficient using document would possibly have the next weight within the calculation than a more moderen car. Elements such because the car’s robbery menace or doable for harm also are most likely integrated within the calculation.

- Instance: A non-member with a blank using document insuring an ordinary sedan in a low-risk space would possibly pay a decrease top class than a member with a historical past of injuries or a non-member insuring a sports activities automobile in a high-theft space.

Have an effect on of Make, Type, and 12 months

The make, style, and yr of a car without delay have an effect on the price of insurance coverage. That is because of components similar to restore prices, robbery charges, and security measures. Automobiles with excessive restore prices, the next chance of being stolen, or fewer security measures in most cases have upper premiums.

Impact of Riding Document and Historical past

A driving force’s using historical past is a vital element in figuring out insurance coverage premiums. Injuries, violations, and claims considerably have an effect on the price. Drivers with blank information experience decrease premiums. For example, a driving force with a historical past of injuries pays the next top class.

Car Location and Utilization

The positioning the place the car is pushed and the frequency of its use affect the top class. Spaces with upper coincidence charges and robbery charges could have upper premiums. Common long-distance using or business use may even in most cases lead to the next top class.

Software and Documentation Procedure

Making use of for USAA automobile insurance coverage for a non-member’s car comes to a rather other procedure than for a member’s car. This segment main points the stairs and required documentation to verify a easy software. Working out those procedures is an important for a a hit software.The appliance procedure for non-members calls for cautious consideration to element and correct submission of all important paperwork. Failure to supply entire and correct data would possibly extend the processing of your software.

Software Steps for Non-Contributors

The appliance procedure for non-members in most cases comes to a number of key steps. At the beginning, you want to collect the specified paperwork. Secondly, entire the appliance shape appropriately. Thirdly, put up the finished software and paperwork to USAA.

Required Documentation, Am i able to get usaa automobile insurance coverage for my female friend’s automobile

This segment Artikels the crucial paperwork wanted for a non-member’s software. Offering all required documentation is essential for the graceful processing of your software.

| Record Sort | Description | Function |

|---|---|---|

| Evidence of Car Possession | Legitimate car identify or registration. | Demonstrates criminal possession of the car. |

| Evidence of Insurance coverage (if acceptable) | Replica of present insurance coverage (if any) for the car. | Supplies details about present protection, if any. |

| Driving force’s License | Legitimate driving force’s license for the principle driving force. | Verifies the identification and using historical past of the principle driving force. |

| Car Data | Main points similar to yr, make, style, VIN, and mileage of the car. | Supplies correct car specs for the insurance coverage. |

| Fee Data | Checking account main points for top class bills. | Facilitates the cost of insurance coverage premiums. |

| Touch Data | Telephone quantity, e-mail cope with, and mailing cope with. | Guarantees right kind communique with USAA. |

Finishing the Software Shape

The appliance shape for non-members ceaselessly calls for filling in private information about the car proprietor and the car itself. Sparsely assessment the shape and make sure accuracy in all fields. This may increasingly save you mistakes and expedite the appliance procedure.

- Evaluation the shape moderately: Make certain that the entire data supplied is correct and entire. Double-check for any mistakes prior to filing.

- Supply correct car data: Make certain that the yr, make, style, VIN, and mileage of the car are exactly documented.

- Correct touch data: Give you the proper touch main points to permit USAA to achieve you for any inquiries.

- Post all important paperwork: You’ll want to have connected the entire required paperwork indexed within the earlier segment.

Abstract of Non-Member Software Procedure

The appliance procedure for non-members differs rather from that of USAA individuals. Crucially, you will have to furnish proof of car possession, driving force’s license, and car main points. Correct crowning glory of the appliance shape and well timed submission of all required paperwork are essential for a easy and environment friendly processing. USAA’s non-member software procedure is designed to successfully assess menace and supply insurance policy.

Choices and Comparability

Making an allowance for USAA automobile insurance coverage in your female friend’s car is a legitimate selection, however exploring selection suppliers allow you to examine protection and pricing. This segment Artikels a number of choices for non-members, highlighting their benefits and downsides, and offering a framework for comparing the most efficient are compatible in your wishes.

Selection Insurance coverage Suppliers

A number of respected insurance coverage corporations be offering aggressive charges and protection choices. Comparing choices supplies a broader standpoint and is helping resolve essentially the most appropriate plan in your female friend’s car.

- State Farm: Recognized for its in depth community of brokers and customized provider, State Farm supplies complete protection choices. An important benefit is its large availability and established recognition, despite the fact that pricing would possibly range relying on components just like the car’s make and style, and your female friend’s using historical past.

- Modern: Modern ceaselessly provides aggressive charges, in particular thru its on-line platform and usage-based techniques. This may translate to decrease premiums for protected drivers, however will not be as complete in relation to customized customer support as every other suppliers.

- Geico: Geico is identified for its on-line accessibility and aggressive pricing, making it a well-liked selection for cost-conscious drivers. It ceaselessly makes use of reductions and on-line gear to decrease premiums, however could have obstacles in relation to the extent of custom designed provider or protection choices when put next to a few competition.

- Allstate: Allstate supplies a variety of protection choices and ceaselessly provides complete coverage applications. Whilst it should have a rather upper reasonable top class when put next to a few competition, its complete method would possibly go well with the ones in quest of in depth coverage.

Analysis Standards

A an important side of choosing the proper insurance coverage is comparing the to be had choices in opposition to your particular wishes. A number of components affect the verdict, together with the car’s price, protection necessities, and the motive force’s using document.

- Protection Choices: Examine the to be had protection choices, together with legal responsibility, collision, complete, and uninsured/underinsured motorist coverage, throughout other suppliers. Assess if the introduced protection adequately addresses your monetary wishes.

- Pricing: Sparsely analyze the top class construction for each and every supplier, making an allowance for the other choices and their related prices. Assessment the criteria influencing top class diversifications, such because the car’s style, utilization, and driving force profile.

- Buyer Provider: Assess the buyer provider recognition of each and every supplier, making an allowance for components like declare processing time, agent availability, and on-line beef up channels. Search for suppliers recognized for responsive and useful customer support.

- Reductions: Inquire about to be had reductions for protected drivers, bundled products and services, and different qualifying components to spot doable financial savings.

Comparative Research

The next desk illustrates a simplified comparability of various insurance coverage suppliers. Actual-world pricing and protection main points can range considerably relying on particular person instances.

| Insurance coverage Supplier | Protection Choices (Instance) | Estimated Top rate (Instance – in step with yr) | Benefits | Disadvantages |

|---|---|---|---|---|

| USAA | Complete legal responsibility, collision, complete | $1,500 | Superb customer support, ceaselessly aggressive pricing for individuals | Restricted to USAA individuals |

| State Farm | Complete legal responsibility, collision, complete | $1,600 | Intensive community of brokers, just right protection choices | Pricing would possibly range considerably |

| Modern | Complete legal responsibility, collision, complete | $1,400 | Aggressive pricing, usage-based reductions | Will have restricted customized provider |

| Geico | Complete legal responsibility, collision, complete | $1,300 | Aggressive pricing, on-line accessibility | Will have restricted customization |

| Allstate | Complete legal responsibility, collision, complete | $1,700 | Wide selection of protection choices, complete coverage | Doubtlessly upper premiums than competition |

Further Issues

Buying USAA automobile insurance coverage for a non-member’s car comes to a number of key concerns past the usual eligibility standards. Working out those components will lend a hand make sure that a easy procedure and an acceptable coverage in your female friend’s automobile.A radical analysis of quite a lot of components, together with using historical past, coverage phrases, and declare procedures, is an important for a well-informed determination. Those sides can considerably have an effect on the top class and general insurance coverage revel in.

Riding Document Implications

The female friend’s using document without delay impacts the insurance coverage top class. A blank document in most cases ends up in decrease premiums. Conversely, a historical past of injuries or violations will most likely build up the price. USAA makes use of a complete review of using historical past, together with the frequency and severity of incidents. This will likely contain reviewing tickets, injuries, and claims information to ascertain a correct menace profile.

For example, a driving force with a historical past of dashing tickets would possibly revel in the next top class in comparison to a driving force with a spotless document.

Significance of Coverage Phrases and Prerequisites

Totally reviewing the coverage phrases and stipulations is very important. Those paperwork Artikel the precise protection, exclusions, and obstacles. Working out those main points prevents surprises and guarantees the coverage aligns together with your wishes. As an example, figuring out the deductible quantity and its software to claims is essential. The coverage will have to explicitly state the stipulations below which protection applies and the precise instances the place protection may well be denied.

Declare Procedures

Working out the declare process is an important for a easy procedure within the match of an coincidence or harm. A transparent figuring out of the stairs interested in submitting a declare is significant. USAA supplies detailed pointers on how one can report a declare, together with reporting necessities, documentation wanted, and the timeline for processing. This comprises directions on how one can touch USAA without delay, reporting the incident to the related government, and the anticipated reaction instances from USAA.

Figuring out those steps guarantees a streamlined procedure.

Contacting USAA Buyer Provider

USAA supplies quite a lot of avenues for contacting customer support. Working out those strategies lets in for environment friendly communique and backbone of questions on protection. This comprises gaining access to on-line assets, contacting customer support representatives by way of telephone, or filing inquiries during the USAA site. Figuring out those channels is essential for addressing particular considerations or clarifying sides of the coverage. Figuring out the to be had touch choices guarantees well timed and environment friendly answer of queries.

End result Abstract

So, getting USAA automobile insurance coverage in your female friend’s automobile is not a assured factor. It depends upon a host of things. Now we have lined the eligibility necessities, choices, prices, and the entire software procedure. With a bit of luck, this data has cleared up any confusion and given you a cast concept of what to anticipate. Now, you’ll be able to make an educated determination about the most efficient insurance coverage in your female friend’s trip.

Peace out!

FAQ Nook

Can I exploit my very own USAA coverage to hide my female friend’s automobile?

Nah, USAA insurance policies normally don’t seem to be designed for protecting other folks’s automobiles except they meet particular stipulations. It is best to test without delay with USAA.

What if my female friend is not a USAA member?

That would make it just a little trickier. USAA has regulations for insuring non-members, so you will have to verify their eligibility standards. It is ceaselessly extra advanced than simply including a brand new automobile.

How does USAA calculate the top class for a non-member’s car?

The top class depends upon a number of components like the auto’s make, style, and yr, the motive force’s historical past, and the positioning. USAA considers these items when atmosphere the price.

Are there any reductions to be had for a non-member’s car?

It relies. USAA would possibly be offering some reductions in keeping with particular components. It is price checking with them without delay.