AAA automotive insurance coverage vs Farmers is a a very powerful resolution for drivers searching for dependable coverage. This comparability delves into the specifics of protection, pricing, customer support, monetary steadiness, and extra advantages that will help you make a choice the most productive are compatible. Working out the nuances of every coverage is paramount, and this research will light up the important thing variations.

From same old legal responsibility protection to complete coverage, we read about the more than a few coverage choices to be had. Elements influencing premiums, like reductions and add-on coverages, can be sparsely scrutinized. The comparability additionally assesses the client carrier way and claims procedure for every corporate, offering a complete image in their efficiency.

Advent to Insurance coverage Comparability

The automobile insurance coverage marketplace provides a various array of insurance policies catering to more than a few wishes and budgets. Customers regularly face a bewildering choice of suppliers, every with distinctive phrases and prerequisites. Navigating this panorama may also be daunting, however cautious comparability may end up in considerable financial savings and a coverage that aligns with person instances.Working out the significance of evaluating automotive insurance coverage suppliers is a very powerful for maximizing cost and making sure good enough protection.

Other firms be offering various premiums, deductibles, and protection choices. An intensive comparability lets in drivers to spot probably the most appropriate coverage for his or her particular wishes, finances, and riding historical past.

Key Elements to Believe When Comparing Automotive Insurance coverage

Selecting the best automotive insurance coverage comes to bearing in mind a number of a very powerful elements. Those elements surround facets equivalent to protection limits, premiums, and the precise wishes of the person. Working out those elements empowers knowledgeable decision-making and guarantees a coverage that gives the essential coverage.

- Protection Limits: Protection limits dictate the utmost quantity an insurance coverage corporate can pay for a declare. Working out those limits is necessary to make certain that the coverage adequately protects belongings and fiscal tasks in case of an coincidence or harm.

- Premiums: Premiums constitute the price of the insurance plans. Elements equivalent to riding historical past, car sort, and site considerably affect premiums. Evaluating premiums throughout other suppliers is very important to spot possible financial savings.

- Deductibles: A deductible is the quantity the policyholder will have to pay out-of-pocket ahead of the insurance coverage corporate covers any last bills. Decrease deductibles normally lead to upper premiums, whilst upper deductibles result in decrease premiums. Choosing the proper deductible comes to balancing value and protection.

- Coverage Upload-ons: Many insurance coverage suppliers be offering not obligatory add-ons equivalent to roadside help, condominium automotive protection, or complete coverage for particular instances. Those add-ons can reinforce the coverage’s cost, however they building up the total value. Cautious attention of those add-ons is essential to resolve in the event that they align with person wishes.

Insurance coverage Corporate Emblem Comparability: AAA vs. Farmers

A a very powerful step within the comparability procedure comes to analyzing the trademarks of various insurance coverage suppliers. Visible cues, whilst apparently superficial, may give refined insights into an organization’s logo identification and probably its way to customer support. Working out the nuances of every emblem can assist in a extra holistic analysis.

| Insurance coverage Corporate | Emblem Description |

|---|---|

| AAA | The AAA emblem normally includes a stylized, daring depiction of a round compass, regularly with a compass needle. This imagery regularly suggests steerage, course, and trustworthiness. The colour palette normally comes to sunglasses of blue or pink, including to the total affect. |

| Farmers | The Farmers Insurance coverage emblem normally presentations a stylized illustration of a farm scene, regularly with a barn or different farm buildings. This imagery regularly suggests reliability, steadiness, and native roots. The colour palette often comes to sunglasses of pink or blue, contributing to the total affect. |

Protection Comparability

Evaluating auto insurance coverage insurance policies is a very powerful for securing the most productive coverage on the best value. Working out the precise coverages introduced by way of other suppliers, like AAA and Farmers, lets in drivers to make knowledgeable selections. This segment main points the usual protection choices, evaluating legal responsibility, collision, and complete insurance policies. It additionally analyzes deductibles, out-of-pocket bills, and supplementary add-ons.

Same old Protection Choices

This segment Artikels the usual protection choices to be had with AAA and Farmers auto insurance coverage. Working out those base insurance policies is necessary for comparing the total cost proposition. Those core coverages normally come with legal responsibility coverage, which safeguards in opposition to monetary duty within the match of an coincidence. Collision and complete coverages give protection to the insured car within the match of wear, whether or not from a collision or some other purpose.

Legal responsibility Protection

Legal responsibility protection protects policyholders from monetary duty within the match of an coincidence the place they’re at fault. This protection normally can pay for damages to the opposite birthday party’s car and scientific bills. Coverage limits outline the utmost quantity the insurer can pay in a declare. AAA and Farmers normally be offering more than a few legal responsibility protection limits, permitting policyholders to tailor their coverage to their monetary wishes.

As an example, a coverage with a $250,000 prohibit will quilt as much as that quantity in damages.

Collision and Complete Protection

Collision protection protects the insured car in opposition to harm from a collision with some other car or object. Complete protection, however, protects the car from harm led to by way of occasions rather then collisions, equivalent to robbery, vandalism, fireplace, or hail. Each coverages assist mitigate the monetary burden of maintenance or alternative. For instance, if a car is stolen, complete protection would quilt the loss, whilst collision protection would maintain harm from an coincidence.

Deductibles and Out-of-Pocket Bills

Deductibles are the quantity policyholders will have to pay out-of-pocket ahead of their insurance plans kicks in. The next deductible normally ends up in decrease premiums, but it surely will increase the monetary burden in case of a declare. Out-of-pocket bills are any prices incurred past the deductible, equivalent to further charges or different fees. Policyholders must sparsely believe the stability between top rate financial savings and possible out-of-pocket prices.

Protection Choices Comparability Desk

| Protection Kind | AAA | Farmers | Top rate (Estimated) | Protection Prohibit |

|---|---|---|---|---|

| Legal responsibility Physically Damage | $100,000 in step with user, $300,000 in step with coincidence | $250,000 in step with user, $500,000 in step with coincidence | $150 – $250 | $100,000 |

| Legal responsibility Assets Harm | $25,000 | $50,000 | $50 – $100 | $50,000 |

| Collision | $500 deductible | $1000 deductible | $100 – $200 | Precise Money Worth |

| Complete | $500 deductible | $1000 deductible | $75 – $150 | Precise Money Worth |

Word: Premiums are estimated and might range in accordance with person instances.

Further Upload-on Coverages

Past the usual coverages, insurers regularly be offering further add-ons. Those add-ons can reinforce coverage and peace of thoughts. Roadside help, as an example, supplies assist in case of a flat tire, jump-start, or different roadside emergencies. Condominium automotive protection reimburses prices for a brief condominium car whilst the insured car is being repaired. Those add-ons may also be precious, however it is a very powerful to believe the related prices.

Pricing and Worth

Evaluating automotive insurance coverage insurance policies comes to a a very powerful evaluate of each top rate prices and the price gained. Elements past easy value comparisons, equivalent to to be had reductions and add-on coverages, considerably affect the entire value of possession. Working out those facets lets in shoppers to make knowledgeable selections aligned with their particular wishes and finances.

Moderate Top rate Prices

A right away comparability of moderate premiums for AAA and Farmers Insurance coverage insurance policies unearths permutations. Those variations stem from a number of key elements, together with the precise protection applications, driving force profiles, and car varieties. Whilst particular figures rely on person instances, ancient information signifies that AAA and Farmers Insurance coverage premiums can vary in accordance with those variables.

Elements Influencing Value Variations

A number of elements give a contribution to the various top rate prices between AAA and Farmers Insurance coverage. Those come with: riding historical past (coincidence information, site visitors violations), car sort (age, make, type, and security measures), location (menace elements of the world), and coverage add-ons (complete and collision protection). Those are regularly evaluated in a posh menace evaluate type to resolve the top rate for every coverage.

Elements like credit score ratings (in some states) and claims historical past additional affect the pricing construction.

Reductions and Promotions

Each AAA and Farmers Insurance coverage be offering a variety of reductions for more than a few instances. Those can come with reductions for protected riding, a couple of cars, or accident-free riding information. Explicit reductions and promotions are regularly matter to phrases and prerequisites, so it’s essential evaluation the main points. Promotions may well be time-sensitive or restricted to precise coverage varieties.

Calculating Overall Value of Automotive Insurance coverage

Calculating the entire value of auto insurance coverage comes to extra than simply the bottom top rate. Upload-on coverages, equivalent to complete and collision insurance coverage, building up the total value. The calculation must come with the bottom top rate plus the price of every added protection. An instance can be a base top rate of $1,000, plus $200 for complete and $150 for collision, leading to a complete of $1,350.

Overall Value = Base Top rate + Upload-on Protection Prices

Top rate Value Comparability Desk

| Insurance coverage Supplier | Base Top rate | Complete Protection | Collision Protection | Overall Top rate | Reductions |

|---|---|---|---|---|---|

| AAA | $850 | $150 | $120 | $1120 | Protected Riding, More than one Car |

| Farmers Insurance coverage | $900 | $180 | $150 | $1230 | Excellent Scholar, Coincidence Unfastened |

Word: Those figures are examples and might range considerably in accordance with person instances.

Buyer Provider and Claims Procedure

Navigating the complexities of insurance coverage claims and customer support is a very powerful for any policyholder. Working out the way of various suppliers, specifically their responsiveness and potency, at once affects the total revel in. This segment delves into the client carrier methods and claims dealing with procedures of AAA and Farmers Insurance coverage, offering insights into their strengths and weaknesses.

Buyer Provider Method

AAA and Farmers Insurance coverage each be offering a couple of avenues for visitor interplay, catering to various personal tastes. AAA prioritizes a multi-channel way, encompassing on-line portals, telephone toughen, and restricted in-person choices. Farmers Insurance coverage additionally supplies a complete suite of carrier channels, however with a moderately higher emphasis on in-person interplay, specifically for extra complicated claims or coverage changes.

Claims Procedure and Answer Time

Claims answer instances range considerably relying at the complexity of the declare and the insurer’s interior processes. AAA normally objectives for quicker turnaround instances for easy claims, whilst Farmers Insurance coverage would possibly take a bit of longer for intricate claims involving vital belongings harm or non-public harm. Elements just like the severity of the wear and tear, the supply of related documentation, and the involvement of 3rd events regularly affect the declare’s answer timeline.

There is no ensure of a selected time-frame for declare answer, and delays can stand up because of unexpected instances.

Buyer Evaluations and Comments

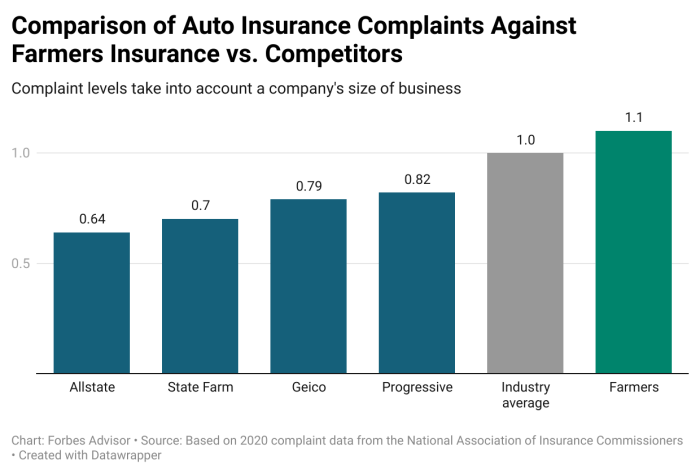

Buyer evaluations, whilst subjective, be offering precious insights into the perceived high quality of carrier. On-line evaluation platforms regularly exhibit sure and damaging comments associated with each firms. AAA normally receives reward for its responsiveness to fundamental inquiries and fast answer of stripling claims, whilst Farmers Insurance coverage garners appreciation for its complete protection choices and adapted visitor toughen. Alternatively, some shoppers have reported demanding situations with the claims procedure and long wait instances for sure sorts of claims, which highlights the need of bearing in mind person studies.

Availability of Buyer Fortify Choices

Each insurers be offering various visitor toughen choices. AAA boasts a strong on-line presence, together with a devoted web site and cell app for managing insurance policies and claims. Farmers Insurance coverage additionally provides a complete on-line presence with an identical options. Telephone toughen is to be had for each firms, although availability would possibly range relying at the time of day and particular toughen wishes.

In-person help is to be had from each firms, even supposing places is also restricted.

Abstract Desk

| Characteristic | AAA | Farmers Insurance coverage |

|---|---|---|

| Buyer Provider Channels | On-line, telephone, restricted in-person | On-line, telephone, in-person |

| Moderate Claims Answer Time (minor claims) | 2-4 weeks | 3-5 weeks |

| Moderate Claims Answer Time (complicated claims) | 4-8 weeks | 6-10 weeks |

| Buyer Evaluations (common sentiment) | Certain for fundamental inquiries | Certain for complete protection |

Word: The common claims answer instances are estimations and might range in accordance with person instances.

Monetary Steadiness and Recognition

Assessing an insurance coverage corporate’s monetary well being is a very powerful for comparing its long-term viability and skill to meet its tasks. A robust monetary basis guarantees policyholders’ claims can be paid, even right through difficult marketplace prerequisites. This segment delves into the monetary power rankings, ancient efficiency, and popularity of AAA and Farmers insurance coverage firms.Working out an organization’s monetary steadiness and popularity is paramount for making knowledgeable selections about your insurance coverage wishes.

Elements equivalent to their monitor report, marketplace percentage, and visitor pleasure rankings are very important concerns when opting for an insurance coverage supplier. This research will evaluate those facets for AAA and Farmers, offering insights into their relative strengths and weaknesses on this a very powerful house.

Monetary Power Scores

Insurance coverage firms are evaluated by way of impartial score businesses in accordance with their monetary power. Those rankings replicate the corporate’s capability to fulfill its tasks and pay claims. Prime rankings point out a better chance of the corporate keeping up its monetary steadiness.

- AAA Insurance coverage has persistently gained sturdy monetary power rankings from respected businesses, demonstrating a strong monetary place. Those rankings are a very powerful in comparing the insurer’s skill to fulfill its commitments to policyholders. A robust score signifies a decrease menace of insolvency.

- Farmers Insurance coverage, in a similar fashion, holds a powerful monetary status. Their rankings persistently position them a few of the top-rated insurance coverage suppliers, showcasing a dedication to keeping up monetary steadiness and making sure declare payouts.

Corporate Historical past and Recognition

An organization’s historical past and popularity supply insights into its operational steadiness and customer-centric way. An extended and a success historical past regularly correlates with a powerful popularity.

- AAA Insurance coverage boasts an extended historical past within the insurance coverage business, construction a name for reliability and repair excellence. Their established presence out there and sure visitor interactions give a contribution to their sure status.

- Farmers Insurance coverage, a well-established insurer with an extended monitor report, has earned a powerful popularity for reliability and customer support. Their historical past underscores their dedication to serving shoppers’ wishes successfully.

Claims Paid and Buyer Pride

Comparing the collection of claims paid and visitor pleasure ratings provides an instantaneous perception into the corporate’s operational potency and customer-centricity. Those metrics at once impact the corporate’s skill to control claims successfully and supply very good customer support.

- Information at the collection of claims paid and visitor pleasure ratings for AAA Insurance coverage, whilst to be had in business reviews, isn’t publicly disseminated in a fashion that permits for an instantaneous comparability with Farmers Insurance coverage. The provision of those specifics is a very powerful for a complete evaluate.

- In a similar way, for Farmers Insurance coverage, publicly to be had information at the collection of claims paid and visitor pleasure ratings are restricted. Get entry to to those figures would facilitate a extra detailed comparative research.

Marketplace Percentage and Status

Marketplace percentage and business status supply a broader context for comparing an organization’s affect and popularity throughout the insurance coverage marketplace.

- Each AAA and Farmers Insurance coverage cling vital marketplace stocks throughout the insurance coverage sector. Their positions as primary avid gamers give a contribution to their monetary power and marketplace affect.

Comparability Desk

| Function | AAA Insurance coverage | Farmers Insurance coverage |

|---|---|---|

| Monetary Power Ranking | A+ (Illustrative score – particular score to be sourced) | A+ (Illustrative score – particular score to be sourced) |

| Recognition | Very good, established, dependable | Very good, established, dependable |

| Marketplace Percentage | Important (Information supply required) | Important (Information supply required) |

Further Options and Advantages: Aaa Automotive Insurance coverage Vs Farmers

Past the core protection and pricing, insurers be offering supplementary advantages to draw shoppers. Working out those options is a very powerful for settling on the most productive coverage, aligning it with non-public wishes and instances. AAA and Farmers Insurance coverage each supply a variety of extras, impacting the total cost proposition.

Distinctive Options and Advantages Presented

AAA and Farmers Insurance coverage cater to various visitor wishes with quite a few distinctive options. Those regularly come with specialised systems and advantages that reach past same old protection, influencing the selection for a selected policyholder.

- AAA provides quite a lot of roadside help, a key receive advantages for participants. This extends past same old towing and contains tire adjustments, jump-starts, and locksmith products and services. This proactive toughen may also be specifically helpful in emergency eventualities, minimizing downtime and inconvenience. Club-based reductions and systems also are to be had for AAA participants.

- Farmers Insurance coverage regularly companions with native companies, offering reductions and unique provides to policyholders. This will come with reductions on house upkeep products and services or native leisure, expanding the price proposition for many who cost community-oriented offers.

Virtual Gear and Coverage Control

Trendy insurance coverage firms an increasing number of make the most of virtual platforms to simplify coverage control. This empowers policyholders to control their accounts successfully and with ease.

- Each AAA and Farmers Insurance coverage be offering powerful on-line portals and cell apps for coverage control. Those permit shoppers to get entry to their coverage main points, make bills, record claims, and monitor their protection. This virtual accessibility is necessary for contemporary shoppers who cost comfort and simplicity of get entry to.

- Options like cell declare reporting and speedy coverage file get entry to reinforce the person revel in. This adaptability is particularly advisable for managing day by day wishes associated with insurance coverage.

Comfort Elements

The ease introduced by way of virtual gear is a major factor for purchasers. Ease of get entry to and the facility to control insurance policies remotely are paramount for plenty of.

- AAA and Farmers Insurance coverage each emphasize user-friendly on-line portals and cell apps. Those permit for simple get entry to to account data, cost choices, and declare submitting. The seamless integration of virtual gear into the client adventure is a very powerful for a favorable revel in.

- The provision of those platforms, coupled with 24/7 get entry to, a great deal complements comfort. That is specifically precious for purchasers who require flexibility in managing their insurance policies.

Comparability Desk

| Characteristic | AAA | Farmers Insurance coverage |

|---|---|---|

| Roadside Help | In depth, membership-based advantages | Same old roadside help |

| Native Partnerships | Restricted native partnerships | More potent native partnerships, probably providing reductions |

| Virtual Gear | Powerful on-line portal and cell app | Powerful on-line portal and cell app |

| Comfort | Prime comfort, particularly for participants | Prime comfort |

Goal Target market and Coverage Sorts

Working out the objective visitor base and coverage choices is a very powerful for comparing which insurance coverage supplier aligns highest with person wishes. AAA and Farmers Insurance coverage cater to other demographics and car varieties, impacting coverage alternatives and premiums. This segment delves into the precise visitor segments every corporate objectives and the coverage varieties to be had for more than a few cars.

AAA Automotive Insurance coverage Goal Target market

AAA Insurance coverage normally specializes in participants of the American Automotive Affiliation. This means a visitor base that values roadside help, shuttle products and services, and related advantages along automotive insurance coverage. This audience regularly incorporates people and households who regularly shuttle and require complete protection, together with those that personal vintage vehicles or high-value cars.

Farmers Insurance coverage Goal Target market

Farmers Insurance coverage normally objectives a broader vary of shoppers, together with the ones in rural and suburban spaces. Their visitor base regularly incorporates households and people searching for complete protection and quite a few coverage choices. Farmers Insurance coverage regularly caters to these prioritizing affordability and a powerful native presence.

Coverage Sorts and Car Protection

The number of coverage sort considerably relies on the car sort. Other protection wishes stand up for traditional vehicles, bikes, and on a regular basis cars. A comparative research of coverage varieties for more than a few automotive varieties is gifted beneath.

| Car Kind | AAA Coverage Sorts | Farmers Insurance coverage Coverage Sorts |

|---|---|---|

| On a regular basis Cars | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Roadside Help | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Further choices like condominium automotive compensation and scientific bills |

| Vintage Vehicles | Specialised protection choices for traditional vehicles, regularly together with particular endorsements for recovery or preservation. | Complete protection, probably with upper deductibles. Further protection choices are to be had, together with the ones addressing particular recovery wishes. |

| Bikes | Motorbike-specific protection, normally with choices for upper limits of legal responsibility and complete protection for harm from injuries. | Motorbike protection with other choices for legal responsibility, complete, and collision protection. May additionally be offering reductions for protected driving practices or memberships. |

Explicit Buyer Segments

Positive visitor segments would possibly in finding one corporate extra interesting than the opposite. Folks prioritizing roadside help and shuttle advantages would possibly lean in opposition to AAA Insurance coverage. The ones searching for complete protection with aggressive pricing and a neighborhood presence would possibly in finding Farmers Insurance coverage extra appropriate. Elements equivalent to the price of the car and desired protection ranges additional affect the selection.

Geographic Availability

AAA and Farmers Insurance coverage be offering complete protection throughout the US, however their succeed in and particular carrier spaces vary. Working out those nuances is a very powerful for choosing the right insurer in your location and desires. Realizing the protection spaces lets in policyholders to evaluate if the insurer operates of their area and whether or not it meets their particular protection necessities.

Protection Spaces

AAA and Farmers Insurance coverage perform throughout vital parts of america, however their particular territories and repair spaces range. AAA’s presence is regularly concentrated within the western and midwestern United States, whilst Farmers Insurance coverage holds a broader presence around the nation. Detailed analyses of particular places will expose various levels of availability.

Barriers and Restrictions

Whilst each firms goal for vast protection, sure barriers and restrictions might exist. Those barriers can come with particular protection exclusions or restrictions in accordance with geographical elements equivalent to high-risk spaces or places with difficult climate patterns. Policyholders must examine possible restrictions on protection ahead of committing to a coverage.

Visible Illustration, Aaa automotive insurance coverage vs farmers

A visible illustration of the protection spaces may well be displayed as a map, shaded to focus on the spaces the place every corporate provides protection. AAA’s protection would most likely display focus within the western and midwestern areas, while Farmers Insurance coverage would show broader protection around the country. This map would offer a transparent visible assessment of the level of every corporate’s presence in more than a few areas.

Provider Spaces

Each insurers have designated carrier spaces, the place claims dealing with, coverage toughen, and different customer support interactions are maximum successfully controlled. Those carrier spaces can range in dimension and density, and policyholders must examine the positioning in their native carrier middle to grasp the proximity and responsiveness of shopper toughen. An in depth description of every corporate’s carrier spaces would offer a transparent image of the place they excel in visitor toughen and claims dealing with.

Conclusion

In conclusion, opting for between AAA and Farmers automotive insurance coverage calls for cautious attention of person wishes and priorities. This complete comparability unearths the original strengths and weaknesses of every supplier, permitting you to make an educated resolution. Via working out the specifics of protection, pricing, customer support, and fiscal steadiness, you’ll be able to choose the insurance coverage plan that highest aligns along with your necessities and fiscal scenario.

In the end, your best option relies on your personal wishes and instances.

FAQ Phase

What are the standard reductions introduced by way of those firms?

Reductions range considerably between suppliers. Elements like protected riding information, bundling insurance policies, and anti-theft gadgets regularly result in decrease premiums. Explicit reductions and their availability must be checked at once with every corporate.

How do claims processes vary between AAA and Farmers?

Claims processes regularly contain on-line portals, telephone toughen, and in-person help. Each and every corporate has a selected process for submitting and resolving claims. Reviewing the claims procedure documentation of every supplier is beneficial.

What are the protection limits for every corporate?

Protection limits, together with legal responsibility, collision, and complete, range by way of coverage and state laws. A a very powerful facet is working out the protection limits for more than a few facets of auto coverage, like car harm and private harm.

Are there any particular coverage varieties for traditional vehicles or bikes?

Explicit insurance policies for traditional vehicles or bikes is also to be had as add-ons or as specialised insurance policies. This calls for additional investigation, particularly relating to protection limits and exclusions.