Reasonable automobile insurance coverage for lecturers is completely a game-changer! Lecturers, you deserve a wreck, and that comes with saving cash for your automobile insurance coverage. We are diving deep into discovering the most efficient offers for you, making an allowance for your distinctive wishes and way of life as a instructor. From discovering the best suppliers to mastering budget-friendly methods, we will equip you with the gear to save lots of severe money.

Believe in spite of everything having more money for your pocket, realizing you were given the most efficient deal imaginable in your automobile insurance coverage. This information is helping you know how to get that incredible deal. We’re going to discover how elements like using conduct, location, or even your automobile sort have an effect on your charges. Plus, we will percentage recommendations on negotiating and the usage of comparability websites to search out the easiest are compatible in your price range.

Defining the Goal Target market

Working out your target market is a very powerful for crafting efficient automobile insurance coverage methods, particularly when focused on a distinct segment like lecturers. Lecturers, a demographic usally lost sight of, have distinctive wishes and monetary constraints that require adapted answers. This phase delves into the specifics of the instructor demographic, highlighting their traits and distinguishing them from different standard automobile insurance coverage patrons.

Instructor Demographics

Lecturers constitute a various workforce, however positive patterns emerge when inspecting their automobile insurance coverage wishes. In most cases, lecturers have a tendency to be middle-aged, with a good portion falling between 30 and 55 years previous. Their using conduct are usally characterised through common commutes, in particular to rural or suburban spaces, now and again with school-related errands. Car varieties are normally family-oriented sedans or SUVs, reflecting their wishes for house and reliability.

Finances constraints are a key issue, impacting their insurance coverage possible choices.

Instructor Using Behavior and Car Varieties

Lecturers usally power extra all over the college 12 months, with a predictable development of commuting and school-related errands. This contrasts with different demographics, like younger execs or retirees, who can have much less predictable using patterns. Their cars are generally family-oriented, emphasizing house and practicality slightly than high-performance options. Sedans and SUVs are not unusual possible choices, reflecting a necessity for reliability and practicality over pace or taste.

Comparability of Instructor Demographics with Different Teams

| Feature | Lecturers | Younger Execs | Retirees |

|---|---|---|---|

| Age Vary | 30-55 | 22-35 | 65+ |

| Car Sort | Sedans, SUVs | Sedans, Coupes, Sporty SUVs | Sedans, Compact Automobiles, Trucks |

| Using Behavior | Common commutes, school-related errands | Variable commutes, town using | Occasional using, shorter journeys |

| Annual Mileage | 15,000-25,000 miles (variable through location) | 10,000-20,000 miles (variable through location) | 5,000-10,000 miles (variable through location) |

This desk illustrates the important thing variations in using patterns, automobile personal tastes, and age vary between lecturers and different demographics. Those distinctions are vital for figuring out the particular wishes and issues of lecturers with regards to automobile insurance coverage. Realizing the everyday annual mileage and most popular automobile varieties of lecturers permits for focused pricing methods and product construction. For instance, a coverage adapted for the predictable mileage of lecturers all over the college 12 months may just be offering value financial savings with out sacrificing protection.

Exploring Insurance coverage Suppliers

Discovering reasonable automobile insurance coverage for lecturers is all about savvy buying groceries. It is not about accepting the primary quote you spot; it is about evaluating apples to apples – and oranges, too, if they are less expensive! We’re going to dive into the arena of insurance coverage suppliers, revealing the most efficient choices for lecturers taking a look to save cash with out sacrificing protection.Insurance coverage firms are not all created equivalent.

Other suppliers have other pricing fashions and particular gives. Working out those nuances is essential to discovering the easiest are compatible in your wishes. We’re going to wreck down the specifics, together with reductions adapted to lecturers, that will help you make an educated choice.

Insurance coverage Corporations Identified for Inexpensive Charges

A large number of insurance coverage firms be offering aggressive charges, however some constantly rank upper. Those suppliers usally have streamlined processes and concentrate on value-driven answers.

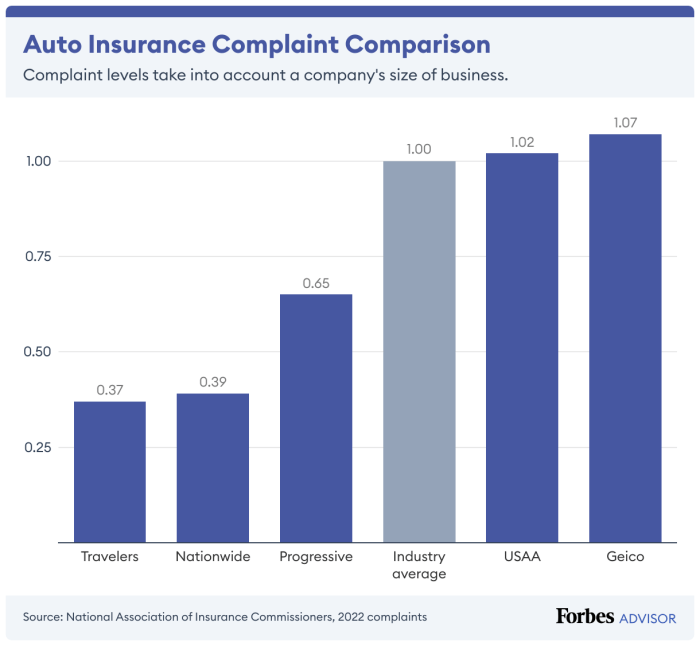

- Geico: Identified for his or her available on-line platforms and often-competitive charges, Geico is a forged possibility for lecturers in the hunt for a easy insurance coverage enjoy. Their on-line gear permit for speedy quotes and comparisons.

- State Farm: A big, well-established logo, State Farm normally gives complete protection choices. They usally have a powerful presence in native communities, offering personalised provider.

- Modern: Modern has a name for aggressive pricing, usally thru their competitive advertising campaigns and bundled reductions.

- Farmers Insurance coverage: Steadily that specialize in rural and suburban spaces, Farmers Insurance coverage would possibly be offering extra personalised charges, in response to particular location wishes.

- Mercury Insurance coverage: A just right possibility for lecturers who need to discover a variety of protection choices and most likely have the benefit of specialised insurance policies, like the ones catering to pupil drivers.

Pricing Methods of Insurance coverage Suppliers

Insurance coverage firms use more than a few methods to resolve charges. Working out those fashions is a very powerful for locating the most efficient deal.

- Utilization-Based totally Insurance coverage: Some firms make the most of knowledge about your using conduct to regulate premiums. This implies more secure drivers can see decrease charges, while extra competitive using may just lead to upper premiums.

- Location-Based totally Insurance coverage: Location performs an important position in insurance coverage prices. Spaces with upper crime charges or coincidence histories generally have upper premiums. For lecturers in those spaces, the most efficient manner is usally a radical comparability to know the associated fee variations.

- Age-Based totally Insurance coverage: Insurance coverage suppliers usally believe the age of the driving force. More youthful drivers normally face upper charges, which is why insurance coverage for younger adults has a tendency to be dearer.

Reductions and Techniques for Lecturers

Many insurance coverage firms acknowledge the worth of lecturers and be offering particular reductions. Those reductions can considerably scale back premiums.

- Instructor Reductions: Those reductions are continuously presented as a part of a partnership with education-focused organizations. Those reductions can range throughout suppliers.

- Multi-Coverage Reductions: When you’ve got a couple of insurance policies with the similar insurance coverage supplier, corresponding to house and auto insurance coverage, you’ll continuously qualify for a cut price.

- Bundling Reductions: Combining your insurance coverage with different services and products, corresponding to telephone and web plans, can now and again yield financial savings.

Comparability of Insurance coverage Suppliers

An in depth comparability will let you choose the most suitable choice.

| Corporate Title | Moderate Fee | Reductions Introduced |

|---|---|---|

| Geico | $1,200 – $1,500 yearly (estimated) | Multi-policy, pupil reductions (if appropriate), secure using systems |

| State Farm | $1,300 – $1,600 yearly (estimated) | Multi-policy, defensive using classes, accident-free information |

| Modern | $1,100 – $1,400 yearly (estimated) | Multi-policy, just right pupil motive force systems, on-line reductions |

| Farmers Insurance coverage | $1,250 – $1,550 yearly (estimated) | Multi-policy, secure using rewards, accident-free information |

| Mercury Insurance coverage | $1,350 – $1,700 yearly (estimated) | Multi-policy, motive force teaching programs, accident-free information |

Notice: Moderate charges are estimations and will range in response to particular person using information, automobile sort, and site. At all times get a personalised quote for correct pricing.

Comparing Protection Choices

Working out the best automobile insurance plans for lecturers is a very powerful. It is not with regards to protective your automobile; it is about safeguarding your monetary well-being and peace of thoughts. Lecturers usally have distinctive wishes, so figuring out the to be had choices and their prices is essential to discovering the most efficient are compatible.Working out the crucial protection varieties and their attainable value implications is paramount when opting for automobile insurance coverage.

The proper protection balances coverage with affordability, making sure you are no longer overpaying for options you are not looking for or underinsured in a possible coincidence.

Very important Protection Varieties for Lecturers

Lecturers, like any drivers, want a stability of protection varieties. Legal responsibility protection protects others in case you are at fault in an coincidence, whilst collision and complete protection give protection to your automobile. Working out the variations between those is important.

Legal responsibility Protection

Legal responsibility insurance coverage covers damages you reason to someone else’s automobile or accidents sustained through others in an coincidence the place you’re at fault. This can be a elementary protection. A minimal legal responsibility protection is generally required through regulation, however upper limits supply extra complete coverage in opposition to attainable monetary burdens. For instance, when you reason considerable injury to some other motive force’s automobile, or accidents are serious, your coverage will lend a hand duvet the prices.

This saves you from catastrophic monetary loss.

Collision Protection

Collision protection can pay for damages for your automobile, without reference to who’s at fault. In case your automobile is broken in an coincidence, collision protection is helping duvet the maintenance or alternative. That is essential, particularly in case you are considering a minor fender-bender or a extra serious coincidence. For instance, a minor coincidence that dents your automobile’s bumper would nonetheless be coated through collision insurance coverage.

Complete Protection

Complete protection protects your automobile from damages no longer led to through a collision, like vandalism, robbery, fireplace, or weather-related occasions. That is particularly helpful in spaces with upper crime charges or inclement climate. For instance, in case your automobile is vandalized or stolen, complete protection would duvet the prices of restore or alternative.

Protection Limits and Prices

Lecturers’ protection wishes range in response to particular person cases and using conduct. Imagine the next when assessing suitable limits.

Conventional Protection Limits for Lecturers

Lecturers usally want upper legal responsibility limits than the minimal required through regulation. That is a very powerful as a result of an important coincidence may just result in considerable monetary responsibilities. For instance, a major coincidence involving a couple of events may just simply exceed minimal legal responsibility limits. A smart manner is to believe a coverage that protects you in opposition to such monetary pressure. Collision and complete protection quantities are usally made up our minds through the automobile’s price.

Have an effect on of Protection Choices on Price

The extent of protection selected considerably impacts the price of insurance coverage. Upper legal responsibility limits, collision, and complete protection usally translate to a better top rate. Then again, good enough protection is a very powerful to give protection to your monetary well-being.

Protection Choices and Conventional Prices

| Protection Sort | Description | Conventional Price Vary (Instance) |

|---|---|---|

| Legal responsibility | Covers damages to others’ belongings and accidents in case you are at fault. | $100-$500 in keeping with 12 months |

| Collision | Covers damages for your automobile without reference to fault. | $100-$400 in keeping with 12 months |

| Complete | Covers damages for your automobile from non-collision occasions (e.g., vandalism, robbery, climate). | $50-$200 in keeping with 12 months |

Notice: Prices are examples and would possibly range in response to location, using document, automobile sort, and different elements.

Assessing Using Behavior and Protection

Your using conduct are a significant factor in how a lot you pay for automobile insurance coverage. Similar to a non-public teacher would not suggest the similar exercise plan for a marathon runner and an off-the-cuff jogger, insurance coverage firms tailor charges in response to particular person possibility profiles. Working out how your using impacts your charges is essential to getting the most efficient deal.Secure using conduct are a right away mirrored image of a motive force’s accountability and consciousness at the highway.

Insurance coverage firms use this information to calculate possibility. Decrease possibility drivers, with demonstrated secure using conduct, usally qualify for decrease premiums. Conversely, the ones with a historical past of dangerous conduct, corresponding to dashing or injuries, face upper premiums. This is not about punishing unhealthy drivers, it is about possibility evaluation. Realizing your conduct and the way they have an effect on your charges empowers you to make knowledgeable selections about your using.

Secure Using Behavior Affect Insurance coverage Charges

Insurance coverage firms meticulously analyze motive force information and using behaviors to resolve the suitable possibility degree and calculate premiums accordingly. A blank using document, indicating accountable conduct at the highway, normally leads to decrease premiums. Conversely, a historical past of violations or injuries, corresponding to dashing tickets or collisions, usally interprets to noticeably upper premiums.

Have an effect on of Location on Insurance coverage Prices for Lecturers, Reasonable automobile insurance coverage for lecturers

Location performs a vital position in insurance coverage prices. Upper coincidence charges in a selected space will lead to upper insurance coverage premiums for citizens of that space. For instance, spaces with excessive site visitors density or a historical past of serious climate prerequisites may just affect insurance coverage charges for lecturers in that area. Elements just like the native highway prerequisites and frequency of injuries in a specific space are usally thought to be through insurance coverage firms.

Dating Between Using Enjoy and Insurance coverage Premiums

Using enjoy is a a very powerful part in insurance coverage top rate calculations. New drivers usally have upper premiums in comparison to skilled drivers. It is because new drivers are statistically much more likely to be considering injuries because of a loss of enjoy and judgment at the highway. Insurance coverage firms view this as a better possibility. As using enjoy will increase and a secure using document is maintained, insurance coverage premiums generally lower.

For example, a newly approved instructor without a using historical past would most likely have upper charges than a instructor with 15 years of enjoy and a spotless using document.

Figuring out and Incorporating Secure Using Practices

To spot secure using practices, you wish to have to keep in mind of your using conduct. Apply your inclinations, corresponding to adherence to hurry limits, keeping up a secure following distance, and warding off distractions. For instance, lecturers, who usally have lengthy commutes and numerous duties, are in particular prone to distractions. Incorporate those practices into your day-to-day using routines.

For example, ensure your telephone is out of achieve, set real looking using occasions, and steer clear of consuming or consuming whilst using.

Using Behavior and Their Have an effect on on Insurance coverage Charges

| Using Addiction | Have an effect on on Insurance coverage Charges |

|---|---|

| Rushing | Considerably upper premiums because of larger possibility of injuries. |

| Injuries | Upper premiums, with the severity of the coincidence impacting the top rate building up. |

| Competitive Using | Upper premiums, as competitive using will increase the chance of collisions and site visitors violations. |

| Distracted Using | Upper premiums, as distractions scale back consciousness and response time, expanding coincidence possibility. |

| Deficient Following Distance | Upper premiums, as insufficient following distance leaves little time to react to unexpected stops or hindrances. |

| Using Below the Affect (DUI) | Extraordinarily excessive premiums, probably leading to denial of protection. |

| Using in Adversarial Prerequisites (e.g., rain, snow, ice) | Upper premiums in spaces with a historical past of serious climate, probably impacting lecturers with lengthy commutes. |

“Secure using conduct are a cornerstone of accountable citizenship and give a contribution considerably to reducing insurance coverage premiums.”

Figuring out Finances-Pleasant Methods

Discovering reasonably priced automobile insurance coverage as a instructor is completely possible. It is not about sacrificing protection; it is about good possible choices. Via figuring out the more than a few methods and leveraging alternatives to barter, you’ll considerably decrease your premiums with out compromising your coverage. Let’s dive into the specifics of lowering your automobile insurance coverage prices.Insurance coverage firms use quite a lot of elements to resolve your top rate.

Some are from your keep an eye on (like your location), however many are at once influenced through your movements and possible choices. We’re going to discover the levers you’ll pull to get the most efficient imaginable charges.

Lowering Automobile Insurance coverage Prices for Lecturers

Lecturers usally face upper insurance coverage premiums because of more than a few elements like their using conduct and way of life. Then again, there are confirmed find out how to struggle those inflated prices. This phase main points a number of efficient approaches.

- Reviewing Your Using Behavior: Your using document is a significant factor for your top rate. When you’ve got any fresh injuries or violations, running to right kind the ones behaviors may end up in considerable financial savings. Imagine defensive using classes to beef up your abilities and scale back the chance of long term incidents. Keeping up a secure using document is a long-term funding that can pay dividends.

- Elevating Your Deductible: Expanding your deductible can considerably scale back your per month top rate. The next deductible manner you’ll be able to pay extra out-of-pocket when you’ve got an coincidence, however this may translate into considerable financial savings for your per month premiums. In moderation weigh the trade-offs between decrease premiums and attainable out-of-pocket bills.

- Bundling Insurance coverage Insurance policies: When you’ve got a couple of insurance coverage insurance policies (householders, renters, and so forth.), bundling them together with your automobile insurance coverage usally supplies considerable reductions. It is because insurance coverage firms are incentivized to retain what you are promoting throughout other product strains. It is a win-win for each you and the supplier.

Negotiating Decrease Premiums with Insurance coverage Suppliers

Negotiating with insurance coverage suppliers can yield spectacular effects. It is about figuring out the criteria that affect your charges after which speaking your case successfully.

- Inquiring for a Quote Comparability: Do not hesitate to invite for a quote comparability from other insurance coverage suppliers. This can be a easy solution to determine probably the most aggressive charges. Other firms use other algorithms and weighting elements, so evaluating apples to apples is important.

- Highlighting Just right Using Historical past: A spotless using document is an important benefit. Obviously keep in touch your constant secure using conduct to the insurance coverage supplier. A historical past of accident-free using is a formidable argument for a decrease top rate.

- The usage of Reductions: Actively hunt down reductions to be had from the insurance coverage supplier. Those reductions could also be tied to express options of your automobile or your way of life (like being a pupil or a instructor). Leverage all to be had reductions.

Advantages of The usage of a Comparability Web page

On-line comparability web sites are a game-changer for locating the most efficient offers. They simplify the method of comparing more than a few insurance coverage choices, making it simple to match charges and protection. They mixture knowledge from a couple of suppliers, permitting you to get an entire evaluate of to be had choices.

- Complete Comparability: Comparability web sites provide a complete evaluate of various insurance coverage choices from more than a few suppliers. They can help you simply evaluate charges and protection choices. This empowers you to make knowledgeable selections in response to correct and complete knowledge.

- Time Potency: Comparability web sites streamline the method of discovering reasonably priced automobile insurance coverage. They can help you briefly evaluate a couple of quotes from other suppliers, saving you substantial effort and time. This time-saving get advantages is particularly precious for lecturers with busy schedules.

Finances-Pleasant Methods Abstract

| Technique | Description | Possible Financial savings |

|---|---|---|

| Evaluate Using Behavior | Toughen using document thru defensive using classes or coincidence prevention methods. | 10-25% |

| Building up Deductible | Elevate the deductible quantity to decrease premiums. | 5-15% |

| Package Insurance coverage Insurance policies | Mix a couple of insurance coverage insurance policies (house, auto, and so forth.) for attainable reductions. | 5-10% |

| Negotiate with Suppliers | Request a quote comparability and spotlight just right using historical past to probably scale back charges. | 5-15% |

| Use Comparability Web pages | Make the most of comparability web sites to match charges from more than a few suppliers. | 5-15% |

Illustrating Price Financial savings: Reasonable Automobile Insurance coverage For Lecturers

Discovering reasonably priced automobile insurance coverage as a instructor is a very powerful for managing budget. This phase dives deep into real-world examples of the way lecturers have effectively reduced their premiums, demonstrating the numerous financial savings attainable to be had with good methods. We’re going to display how those financial savings can translate into tangible monetary advantages, like further finances for school room provides, skilled construction, or perhaps a genuinely-earned holiday.

Case Find out about: Sarah’s Insurance coverage Financial savings

Sarah, a highschool English instructor, was once paying $250 monthly for automobile insurance coverage. Unsatisfied with the associated fee, she made up our minds to discover other methods. She began through evaluating quotes from more than a few suppliers, finding an organization providing a fifteen% cut price for secure using information. This by myself lowered her per month fee to $212.50. Additional, she upgraded her automobile’s anti-theft device, securing a ten% cut price, and she or he additional lowered her premiums through 5% through choosing a better deductible.

Examples of A success Price Discounts

Past Sarah’s tale, many lecturers have skilled identical luck. One instructor, Mark, lowered his premiums through 20% through switching to a telematics insurance coverage supplier. This supplier screens using conduct and rewards secure drivers with decrease premiums. Any other instructor, Emily, opted for a bundled insurance coverage bundle, combining her auto, house, and lifestyles insurance coverage, securing a considerable cut price on her auto coverage.

Those are simply two examples highlighting the variability of attainable financial savings to be had.

Possible Price Financial savings

The monetary have an effect on of those financial savings can also be important for lecturers. A $30-40 per month relief in premiums may just permit for extra school room provides or skilled construction classes. Amassed financial savings through the years can duvet sudden automobile maintenance, supply finances for summer season breaks or family members holidays, and even give a contribution to retirement financial savings. Those methods, when mixed, can release considerable monetary advantages for lecturers.

Methods and Possible Financial savings Desk

| Technique | Possible Financial savings (Per 30 days) | Rationalization |

|---|---|---|

| Evaluating Quotes from A couple of Suppliers | $15-30 | Other firms be offering various charges. Buying groceries round is essential. |

| Secure Using Information | $10-25 | Insurance coverage firms usally praise secure drivers with reductions. |

| Telematics Insurance coverage | $15-30 | The usage of a tool that screens using conduct for reductions. |

| Bundled Insurance coverage Applications | $10-20 | Combining auto, house, and lifestyles insurance coverage may end up in reductions. |

| Upper Deductible | $5-15 | Opting for a better deductible can decrease your top rate, however you’ll be able to pay extra out-of-pocket in case of an coincidence. |

| Anti-theft Instrument Set up | $5-10 | Putting in anti-theft gadgets for your automobile can qualify you for reductions. |

Ultimate Conclusion

So, there you will have it—a complete have a look at snagging reasonable automobile insurance coverage as a instructor! Now we have coated the whole thing from figuring out your must discovering the best suppliers and budget-friendly methods. Armed with this data, you are now utterly provided to save lots of severe money for your automobile insurance coverage, leaving you with extra moolah for all the ones essential issues. In a position to save lots of giant?

FAQ

Q: What is the moderate age vary for lecturers purchasing automobile insurance coverage?

A: Lecturers are generally within the 25-55 age vary, however can range. This affects insurance coverage charges because of possibility elements.

Q: Are there particular reductions for lecturers?

A: Many insurance coverage suppliers be offering reductions for lecturers. Glance into those offers! Some firms also have particular systems for educators.

Q: How do I negotiate decrease premiums with insurance coverage suppliers?

A: Be ready to give an explanation for your using historical past and any secure using practices you observe. Realizing your coverage main points is helping you negotiate extra successfully.

Q: What if I am a brand new instructor and feature restricted using historical past?

A: Some insurance coverage firms would possibly be offering particular charges for brand new drivers or would possibly require upper deductibles. It is price checking with a couple of suppliers to match gives.