Automobile insurance coverage Sioux Falls SD: Navigating the labyrinthine international of vehicle insurance coverage in Sioux Falls can really feel like a frightening job. From working out the various coverage choices to decoding the standards influencing premiums, securing the proper protection can really feel overwhelming. This complete information meticulously examines each aspect of vehicle insurance coverage in Sioux Falls, SD, providing readability and empowering you to make knowledgeable selections.

Unraveling the complexities of legal responsibility, collision, and complete protection, this information illuminates the nuanced variations between those insurance policies. We will delve into standard protection quantities and premiums, bearing in mind a very powerful variables like automobile kind and using historical past. Moreover, we will be able to discover the position of deductibles and the supply of crucial add-ons like roadside help. Get ready to embark on a adventure to grasp the panorama of vehicle insurance coverage in Sioux Falls, SD, the place you are going to emerge empowered to take advantage of fantastic selection.

Automobile Insurance coverage Choices in Sioux Falls, SD

Navigating the arena of vehicle insurance coverage can really feel overwhelming, particularly when taking into account the original wishes of Sioux Falls, SD. Working out the other coverage varieties, protection quantities, and premiums is essential to securing the proper coverage in your automobile and fiscal well-being. This exploration will delve into the more than a few choices to be had, empowering you to make knowledgeable selections about your automobile insurance coverage wishes.

Legal responsibility Protection

Legal responsibility insurance coverage protects you from monetary accountability should you reason harm to someone else’s belongings or injure them in an coincidence. It is incessantly a compulsory part of vehicle insurance coverage insurance policies in Sioux Falls, as mandated via state laws. The everyday top rate vary for legal responsibility protection in Sioux Falls varies relying on components similar to your using document, automobile kind, and placement inside the town.

Premiums usually fall between $50 and $200 per thirty days. Crucially, protection quantities are incessantly tied to state minimums, which will range and would possibly not absolutely duvet possible damages or accidents.

Collision Protection

Collision insurance coverage covers damages on your automobile in an coincidence, without reference to who’s at fault. This is very important coverage in your funding on your automobile. Collision protection premiums in Sioux Falls, like legal responsibility, are influenced via components similar to your using document, automobile kind, and placement. Standard top rate levels also are between $50 and $200 per thirty days, however those premiums can range relying to your automobile’s make, style, and worth.

A better automobile worth incessantly interprets to a better top rate.

Complete Protection

Complete protection safeguards your automobile towards damages from occasions past injuries, similar to vandalism, robbery, hail harm, or hearth. Complete protection premiums in Sioux Falls are usually in the similar vary as collision protection. Those premiums are impacted via the standards that impact collision protection. This protection provides peace of thoughts, protective your funding from unexpected cases.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you and your automobile if you are concerned about an coincidence with a driving force who lacks enough insurance coverage or is uninsured. This protection is a very powerful in Sioux Falls, a town with numerous automobiles at the highway. Premiums for this protection range in keeping with your using historical past, location, and the particular protection quantities you select.

Deductibles and Their Have an effect on

Deductibles are the quantity you pay out-of-pocket sooner than your insurance coverage corporate begins protecting the prices of upkeep or damages. Decrease deductibles usually imply upper premiums, whilst upper deductibles lead to decrease premiums. Choosing the proper deductible steadiness is a essential attention on your insurance coverage decision-making procedure.

Upload-on Coverages

Upload-on coverages similar to roadside help and condo automobile protection can make stronger your insurance coverage bundle. Roadside help supplies lend a hand in eventualities like a flat tire or a lifeless battery. Apartment automobile protection is helping you protected a short lived automobile in case your automobile is broken and unavailable for a duration.

Coverage Comparability Desk

| Coverage Sort | Description | Standard Top rate Vary (Sioux Falls, SD) | Protection Quantity |

|---|---|---|---|

| Legal responsibility | Covers damages to others’ belongings or accidents. | $50-$200 per thirty days | Variable, in keeping with state minimums. |

| Collision | Covers damages on your automobile in an coincidence. | $50-$200 per thirty days | Variable, in keeping with automobile worth and deductible. |

| Complete | Covers damages from occasions as opposed to injuries. | $50-$200 per thirty days | Variable, in keeping with automobile worth and deductible. |

| Uninsured/Underinsured Motorist | Protects you in injuries with uninsured/underinsured drivers. | Variable | Variable, in keeping with protection decided on. |

Elements Affecting Automobile Insurance coverage Premiums in Sioux Falls

Automobile insurance coverage premiums in Sioux Falls, like in every single place else, don’t seem to be a one-size-fits-all determine. Quite a lot of components affect the price of your coverage, out of your using conduct to the make and style of your automobile. Working out those components allow you to to find essentially the most reasonably priced protection.

Riding Document

Riding data are an important determinant in insurance coverage premiums. A blank using document, freed from injuries and site visitors violations, usually leads to decrease premiums. Conversely, injuries and violations, particularly critical ones, result in considerably upper premiums. It’s because insurers assess menace in keeping with historic information; a driving force with a historical past of injuries or violations is deemed a better menace, requiring a better top rate to hide possible claims.

For example, a driving force concerned about a significant coincidence will most likely face a considerable building up of their insurance coverage prices, probably lasting a number of years. Site visitors violations like dashing tickets or reckless using additionally give a contribution to raised premiums.

Car Sort and Style

The sort and style of your automobile play a a very powerful position on your insurance coverage prices. Luxurious automobiles and high-performance sports activities automobiles incessantly include upper premiums. That is because of their larger restore prices and the opportunity of upper declare payouts within the tournament of an coincidence. Insurers believe components just like the automobile’s worth, its make and style, and its possible for harm when figuring out premiums.

This is not at all times the case, even though, as a selected automobile’s value level and service prices range considerably.

Age and Location

Age is a essential issue. More youthful drivers incessantly face upper premiums than older drivers because of their perceived upper menace of injuries. Inside of Sioux Falls, location too can affect charges. Spaces with upper coincidence charges or upper concentrations of at-risk drivers might see upper premiums for citizens in the ones particular spaces. Those components are in moderation thought to be via insurers, bearing in mind focused menace overview and adapted premiums.

Reductions To be had

A lot of reductions are to be had to Sioux Falls citizens. Protected driving force reductions praise drivers with impeccable data, whilst multi-policy reductions incentivize bundling insurance coverage insurance policies with the similar insurer. Reductions for excellent pupil standing, anti-theft units, and usage-based techniques (telematics) too can lend a hand cut back premiums. Those reductions are designed to incentivize secure using conduct and inspire accountable insurance coverage practices.

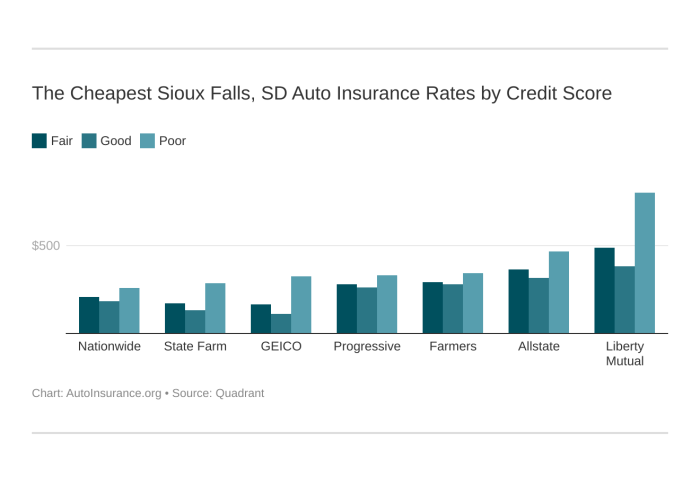

Credit score Ranking

Credit score rankings, unusually, can affect your automobile insurance coverage premiums in Sioux Falls. Drivers with excellent credit score rankings incessantly qualify for decrease premiums. Insurers consider that folks with a favorable credit score historical past have a tendency to be extra accountable and no more prone to have interaction in dangerous behaviors. This can be a essential consider assessing a driving force’s general menace profile, as a decrease credit score ranking incessantly correlates with larger monetary menace.

Elements Affecting Automobile Insurance coverage Premiums

| Issue | Description | Have an effect on on Premiums |

|---|---|---|

| Riding Document | Injuries, violations | Upper premiums for injuries or violations |

| Car Sort | Luxurious, sports activities automobiles | Probably upper premiums because of upper restore prices and possible for upper declare payouts. |

| Age | More youthful drivers | Upper premiums because of upper coincidence charges. |

| Location | Spaces with upper coincidence charges | Upper premiums in high-risk spaces. |

| Reductions | Protected driving force, multi-policy | Decrease premiums for eligible drivers. |

| Credit score Ranking | Creditworthiness | Decrease premiums for drivers with excellent credit score rankings. |

Insurance coverage Firms Serving Sioux Falls, SD

Discovering the proper automobile insurance coverage in Sioux Falls, SD, comes to taking into account a number of components past simply value. Working out the reputations, monetary strengths, customer support, and claims processing instances of various insurance coverage firms is a very powerful to creating an educated resolution. This is helping you choose an organization that aligns along with your wishes and expectancies, making sure a smoother revel in within the tournament of a declare.

Main Insurance coverage Firms in Sioux Falls

A number of primary insurance coverage firms be offering automobile insurance coverage in Sioux Falls. Those firms have established monitor data and ranging ranges of monetary balance, impacting their skill to satisfy claims and deal with carrier requirements.

- State Farm: Identified for its in style community and intensive protection choices. State Farm constantly ranks excessive in buyer pleasure surveys, incessantly praised for its responsive customer support and environment friendly claims dealing with. They provide a wide selection of insurance policies and reductions.

- Revolutionary: A well-known logo recognized for its leading edge method to insurance coverage. Revolutionary incessantly makes use of generation to give a boost to claims processes and supply aggressive pricing. Their customer support rankings usually fall inside the moderate vary.

- Allstate: A big, established corporate with a large presence within the insurance coverage marketplace. Allstate is typically thought to be financially sound and gives a spread of vehicle insurance coverage merchandise. Customer support rankings can range relying at the particular person agent and place of work.

- Farmers Insurance coverage: A well-liked selection for rural communities, Farmers Insurance coverage additionally caters to city spaces like Sioux Falls. Their popularity emphasizes customized carrier, even though claims processing instances might range relying at the particular declare.

- Geico: Incessantly related to aggressive pricing, Geico provides plenty of automobile insurance policy. Their claims processing potency and customer support are typically well-regarded.

Monetary Energy and Recognition

Comparing the monetary power of an insurance coverage corporate is a very powerful. Insurers with robust monetary rankings are higher provided to take care of claims and deal with long-term balance. Firms like State Farm incessantly dangle excessive A.M. Best possible rankings, indicating a powerful monetary place. Revolutionary, whilst leading edge, can have a relatively decrease ranking in comparison to State Farm.

That is essential as a result of an organization’s monetary well being at once affects their skill to pay claims, particularly in primary occasions.

Buyer Carrier and Claims Processing

Customer support and claims processing are essential components. An organization recognized for suggested claims processing and superb customer support reduces pressure right through a troublesome time. For example, State Farm incessantly receives sure critiques for dealing with claims successfully. Geico, regardless of from time to time having aggressive pricing, may have relatively longer claims processing instances in comparison to State Farm. Customer support rankings incessantly replicate the revel in of particular person brokers and place of work places.

Protection Choices and Premiums

Other firms be offering various protection choices and premiums. The most suitable option for you is dependent upon your particular wishes and finances. As an example, State Farm can have a relatively upper top rate in comparison to Geico for the same protection bundle. Allstate and Farmers insurance coverage most often supply a balanced vary of protection choices. It’s worthwhile to examine insurance policies in keeping with protection, deductibles, and exclusions.

| Insurance coverage Corporate | Recognition | Buyer Carrier Score | Claims Processing Time |

|---|---|---|---|

| State Farm | Sturdy | Superb | Speedy |

| Revolutionary | Excellent | Reasonable | Reasonable |

| Allstate | Excellent | Variable | Reasonable |

| Farmers Insurance coverage | Sturdy | Excellent | Reasonable |

| Geico | Excellent | Reasonable | Reasonable |

Guidelines for Discovering Reasonably priced Automobile Insurance coverage in Sioux Falls

Discovering the proper automobile insurance coverage in Sioux Falls, SD, can really feel like navigating a maze. Alternatively, with a strategic way, you’ll be able to considerably cut back your premiums and get the most efficient protection in your wishes. Working out the strategies for evaluating quotes, using on-line equipment, and negotiating with brokers are key steps towards discovering reasonably priced automobile insurance coverage.

Evaluating Quotes from Quite a lot of Suppliers

Evaluating quotes from more than one insurance coverage suppliers is very important for securing the most efficient imaginable price. This procedure comes to amassing quotes from other firms to spot essentially the most aggressive provides. It is a proactive step that lets you perceive the cost variations and select the coverage that most nearly fits your finances and wishes.

- Make the most of on-line comparability equipment. Those equipment mean you can enter your automobile data, using historical past, and desired protection to obtain immediate quotes from more than a few insurers. As an example, a person can input their automobile’s make, style, 12 months, and placement, together with their using document and desired protection to look speedy quotes from more than one firms. This protects you the effort and time of contacting every insurer in my opinion.

- Touch insurance coverage brokers at once. Do not disregard the worth of private interplay with insurance coverage brokers. They are able to supply customized recommendation and probably protected higher charges in keeping with your distinctive cases, similar to reductions for excellent using data or particular protection choices.

- Request more than one quotes. It is extremely beneficial to gather quotes from no less than 3 to 5 other insurance coverage suppliers. This offers a broader standpoint and lets you examine insurance policies successfully. A much wider vary of choices lets you perceive the differences in pricing and contours.

The use of On-line Comparability Gear Successfully, Automobile insurance coverage sioux falls sd

On-line comparability equipment may also be tough allies on your quest for reasonably priced automobile insurance coverage. They streamline the quote-gathering procedure, offering a transparent review of various insurance policies and their related prices.

- Enter correct data. Offering correct information about your automobile, using document, and protection personal tastes is a very powerful for acquiring actual quotes. This contains main points like your automobile’s age, style, and any add-ons or changes, together with your using historical past and desired protection varieties. Correct information will result in extra correct and related quotes.

- Evaluate options and protection. Scrutinize the protection choices supplied via every insurer. Glance past simply the cost; examine the forms of protection, deductibles, and any further advantages. For example, examine the excellent protection choices, the legal responsibility protection, and the collision protection introduced via every insurance coverage supplier.

- Overview reductions. Many insurers be offering reductions for secure using, more than one insurance policies, or different components. Actively search for those reductions, as they may be able to considerably cut back your top rate. Reductions are incessantly to be had for excellent using data, for bundling insurance coverage insurance policies, or for particular options of your automobile.

Negotiating Decrease Premiums with Insurance coverage Brokers

Insurance coverage brokers incessantly have the versatility to barter premiums. Proactive conversation and working out the standards influencing charges can lend a hand protected higher offers.

- Be ready to talk about your wishes. Have a transparent working out of your required protection and finances. This readability is helping the agent tailor a coverage that meets your particular necessities whilst staying inside your monetary constraints.

- Inquire about reductions. Actively inquire about any to be had reductions, similar to the ones for excellent using data, anti-theft units, or safe-driving techniques. Do not hesitate to invite about reductions for more than one insurance policies or different probably acceptable discounts.

- Evaluate provides from more than one brokers. Getting quotes from other brokers can lead to a much broader vary of choices and probably higher charges. This comparability lets in you to make a choice essentially the most aggressive and appropriate possibility.

Bundling Insurance coverage Insurance policies to Save Cash

Bundling more than one insurance coverage insurance policies, similar to automobile, house, or lifestyles insurance coverage, can incessantly result in considerable financial savings. Insurance coverage firms incessantly supply reductions for bundling insurance policies to praise their unswerving shoppers and inspire long-term relationships.

- Analyze possible financial savings. Overview the possible financial savings from bundling insurance policies with the similar insurance coverage corporate. Believe whether or not the financial savings justify the added comfort and possible advantages of getting more than one insurance policies underneath one supplier.

- Believe some great benefits of a unmarried supplier. A unmarried supplier for all of your insurance coverage wishes can streamline the control of insurance policies and make sure a cohesive method to insurance plans.

The Advantages of Having More than one Insurance coverage Quotes

Acquiring more than one insurance coverage quotes is a treasured follow that gives quite a lot of advantages. It lets you examine costs, protection, and contours from more than a few insurers, empowering you to make an educated resolution.

- Maximize financial savings. By means of evaluating quotes, you building up your probabilities of securing essentially the most reasonably priced coverage that aligns along with your wishes. This proactive way guarantees you might be no longer overpaying in your automobile insurance coverage.

- Make knowledgeable selections. More than one quotes provide you with a transparent working out of the to be had choices, enabling you to make a choice the coverage that most nearly fits your finances and necessities. This complete review empowers you to make among the best selection.

Native Automobile Insurance coverage Brokers in Sioux Falls

Discovering the proper automobile insurance coverage in Sioux Falls, SD, could be a breeze with the assistance of a neighborhood agent. They provide customized carrier and deep working out of the native marketplace, which incessantly interprets to raised charges and extra adapted protection choices. Navigating the advanced international of insurance coverage may also be daunting, however a neighborhood agent can simplify the method and be sure to’re well-protected.

Native Insurance coverage Brokers in Sioux Falls, SD

Discovering the proper insurance coverage agent is a very powerful for purchasing the most efficient imaginable protection. An area agent possesses in-depth wisdom of the particular insurance coverage wishes and demanding situations confronted via drivers in Sioux Falls. This localized experience incessantly leads to extra aggressive charges and adapted insurance policies.

- John Smith Insurance coverage: Supplies complete automobile insurance coverage answers adapted to particular person wishes. John Smith is very skilled within the native marketplace and has a very good popularity for buyer pleasure. Touch: 605-555-1212, information@johnsmithinsurance.com

- Miller & Buddies Insurance coverage: Gives quite a lot of automobile insurance coverage choices with a focal point on customer support and clear conversation. Miller & Buddies understands the original using stipulations and insurance coverage laws in Sioux Falls. Touch: 605-555-3456, information@millerinsurance.com

- Dakota Insurance coverage Crew: Makes a speciality of automobile insurance coverage for more than a few forms of automobiles and drivers. Dakota Insurance coverage Crew has a group of mavens conversant in the native insurance coverage panorama. Touch: 605-555-7890, information@dakotains.com

Benefits of Native Brokers

Native brokers be offering distinct benefits over on-line suppliers. Their native wisdom is precious, permitting them to tailor protection to precise native dangers. In addition they supply customized carrier, making sure a adapted way on your wishes. This incessantly interprets into a greater working out of the specifics of the coverage and probably decrease premiums. Moreover, native brokers are readily to be had for in-person consultations, enabling direct interplay and addressing any considerations promptly.

In-Particular person Consultations

In-person consultations with a neighborhood agent are extremely recommended. This permits for a deeper working out of your own wishes and using historical past. The agent can speak about particular protection choices, tailor the coverage on your distinctive cases, and deal with any questions you could have in real-time. This customized way guarantees a transparent working out of your coverage and any possible dangers.

Opting for an Agent In response to Revel in and Experience

When settling on an agent, believe their revel in and experience. Search for brokers with a confirmed monitor document within the native marketplace. Analysis their revel in and popularity, probably thru on-line critiques or referrals from relied on resources. A extremely skilled agent is prone to have a broader working out of native laws and the original wishes of drivers in Sioux Falls, resulting in simpler answers and probably decrease premiums.

End result Abstract: Automobile Insurance coverage Sioux Falls Sd

In conclusion, securing the proper automobile insurance coverage in Sioux Falls, SD, calls for cautious attention of more than a few components. From evaluating coverage varieties and premiums to working out the affect of using data and automobile traits, this information equips you with the data to navigate the complexities of the marketplace. By means of working out the nuances of various insurance coverage firms, some great benefits of native brokers, and methods for locating reasonably priced choices, you’ll be able to be well-positioned to make a choice the perfect coverage that fits your wishes and finances.

In the long run, this information empowers you to make a assured resolution that may give protection to you and your automobile in Sioux Falls.

Questions Incessantly Requested

What’s the moderate value of legal responsibility insurance coverage in Sioux Falls, SD?

Legal responsibility insurance coverage premiums in Sioux Falls, SD, usually vary from $50 to $200 in step with 12 months, relying on particular person components like using historical past and automobile kind.

Can I am getting a cut price on my automobile insurance coverage if I’ve a blank using document?

Sure, many insurance coverage firms be offering reductions for secure drivers with blank using data, demonstrating a dedication to accountable using.

How does my credit score ranking impact my automobile insurance coverage premiums in Sioux Falls?

Credit score rankings could be a consider figuring out your automobile insurance coverage premiums in Sioux Falls, SD, as insurers believe them signs of menace control.

Are there any particular reductions to be had to citizens of Sioux Falls?

Reductions like secure driving force reductions or multi-policy reductions are repeatedly to be had to citizens of Sioux Falls, SD, providing alternatives to scale back insurance coverage premiums.